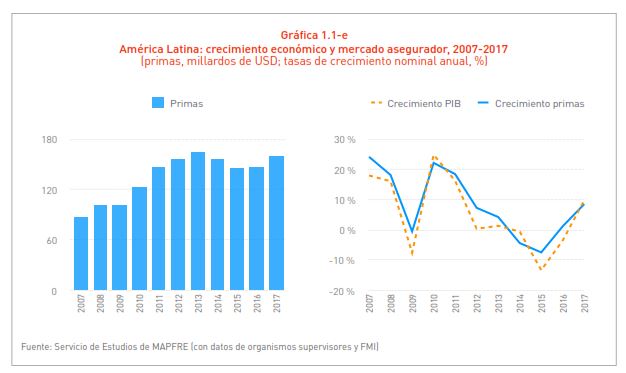

The report, presented during the “Economy and Insurance in Latin America” webinar, indicated that the Latin American insurance market grew by 8.6% in 2017 up to 159,000 million dollars. The penetration index and the level of insurance depth in the region also increased.

According to the report prepared by the MAPFRE Economic Research and edited by Fundación MAPFRE “The Latin American Insurance market in 2017” the insurance market in Latin America and the Caribbean increased by 8.6% in premiums up to 159,217 million dollars in 2017, with 54.6% of these registered in Non-Life and another 45.4% in Life insurance.

As an aggregated total, Life insurance premiums increased by 9% in 2017, compared with 7% registered in 2016, while Non-Life insurance increased by 8.2%, compared with a fall of 3.1% recorded in the previous year.

Good economic performance and greater purchasing power in homes and companies contributed to a notable increase in non-life business, influenced by the push forward in the Automobile sector (which increased by 9.3% compared with -4.9% in 2016), and which contributed to 19.2% of the total premiums.

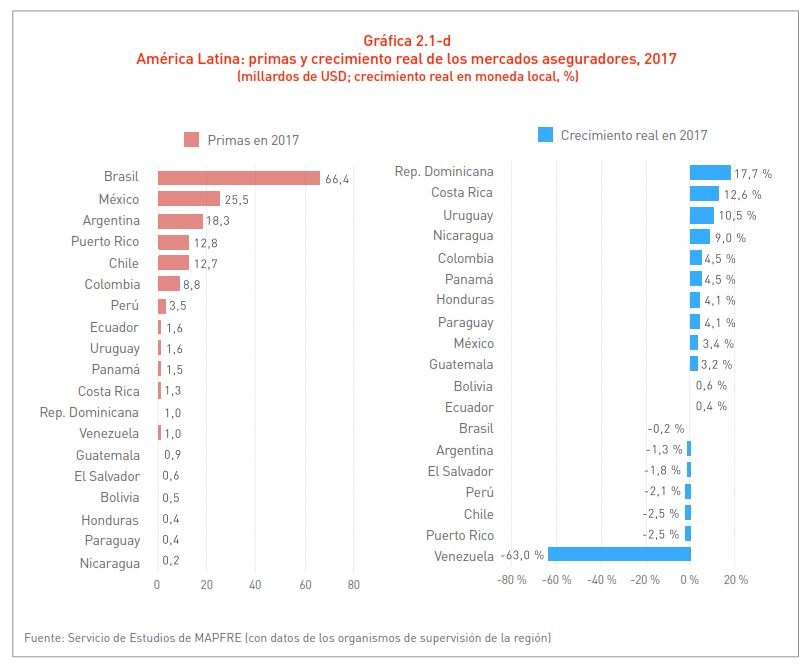

The analysis demonstrates that the majority of the markets registered positive premium growth in local currency and in real terms, with some exceptions such as Argentina, Brazil, Chile, El Salvador, Peru, Puerto Rico and Venezuela. The Argentinian, Brazilian and Venezuelan markets experienced nominal growth, although this became an actual real decrease due to inflation. Nonetheless, the vast majority of markets experienced growth in premium volume measured in dollars.

Characteristics of their development

The analysis underscores an improvement in market share in this region, which has reached 3.4% of worldwide insurance premiums.

The participation of the Latin American market in the global total has been increasingly steadily over time, both in the Life and in the Non-Life sector, reaching 3.4% in 2017. Although still far from the large and more developed regional markets, it does however reflect the market potential of the region.

The development of the sector in Latin America is characterized by a sustained increase in penetration levels and by the continued increase in insurance depth, a structural trend which significantly differentiates the insurance industry in the region from other industries and demonstrates the future prospects for its development.

The report cautions that Latin American insurance has a long way to go before it reaches the penetration rates and the depth of advanced markets, and can thereby reduce its insurance gap.

Analyzing the evolution of the penetration indicator since 2007, there has been a 0.6 point increase, which confirms the growing trend of the last decade, to which the development of Life insurance has contributed, and, to a lesser degree, that of Non-Life insurance. In the medium-term analysis the depth indicator also improved, with an accumulated increase of 8.8 points and an accumulated growth of 24.1% in that period.

With regard to the Insurance Protection Gap, which represents the difference between insurance cover which is economically necessary and beneficial for society and the amount of said cover actually acquired, this stood at 256 billion dollars, having grown 5.2% compared to the 2016 estimates.

Economic prospects for 2018

The MAPFRE Economic Research also puts forward its prospects for economic growth in its analysis which, globally, stands at around 3.8%, and near 2% for developed markets and 4.9% for emerging markets.

The analysis refers to a continuing growth trend in the global economy for this year and a certain disparity in monetary policy, with contained inflation levels. With regard to risks, it warns of emerging risks and global geopolitical problems.

Lastly, for each of the markets analyzed there has been a specific analysis of the principle development indicators and structural trends, and a description of important regulatory aspects.

For more details you can access the full reports in “Reports and Documents of the sector”