admin | 16/11/2021

The gas outlook in Latin America is characterized by great potential and an unequal development across regions, as it faces a stage of broad possibilities within the framework of a global commitment to decarbonization. Pablo Ferragut, coordinator of the Gas Committee at ARPEL (Regional Association of Companies in the Oil, Gas and Biofuel Sector in Latin America), tells us about the production, consumption and marketing of natural gas in the territory.

The integration of gas in Latin America mainly exists and occurs in the Southern Cone, a region that has a consolidated infrastructure and commercial activity among the different countries that comprise it. “Currently, Bolivia exports to Brazil and Argentina; and the latter to Uruguay, Chile and Brazil,” explains Pablo Ferragut, coordinator of the ARPEL Gas Committee. In addition, as pointed out by the Gas Committee of the Latin American association, Mexico is a large importer of natural gas from the United States, with which it is interconnected through several gas pipelines, just like Colombia and Venezuela, although they are not currently active. “I believe that, due to the factors of supply and demand, there are opportunities to intensify integration in the Southern Cone and, also by way of a new paradigm, through Liquefied Natural Gas (LNG), since more and more countries are developing their infrastructure,” Mr. Ferragut says.

Unequal development across regions

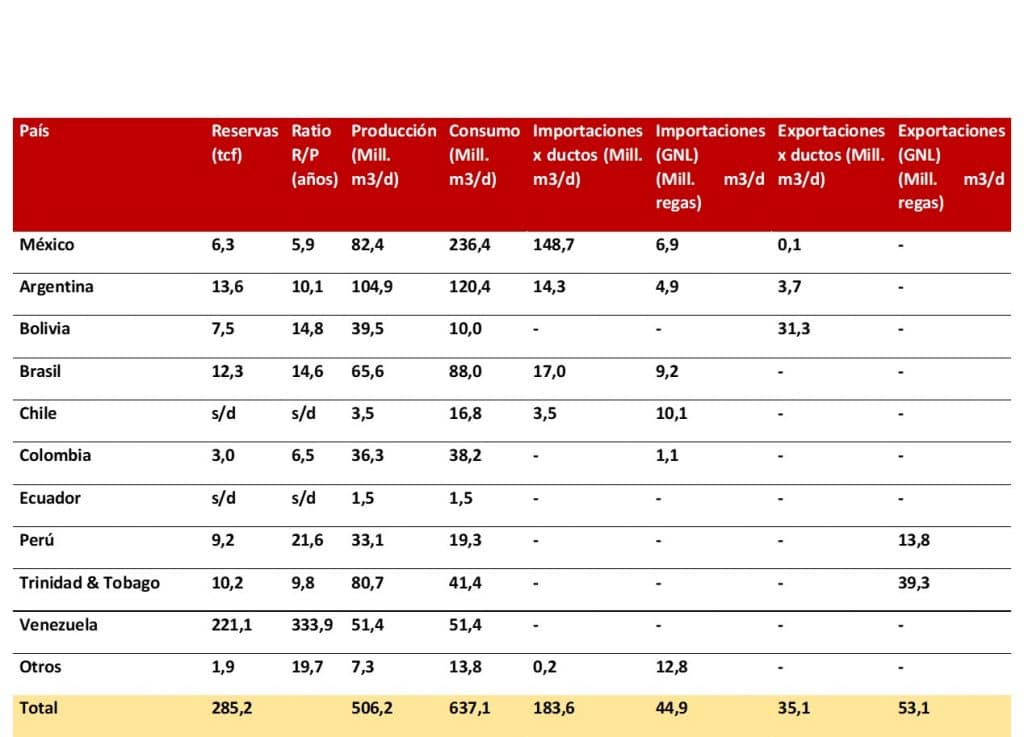

The gas sector currently has a very unequal development throughout the Latin American region, and there is a lot of diversity among countries, with very different production, consumption and marketing profiles. “We could say that the producing countries are Argentina, Bolivia, Brazil, Peru, Colombia, Mexico, Trinidad and Tobago and Venezuela, although there is also a small production in Chile and Ecuador that is consumed locally,” according to ARPEL.

“Of the countries mentioned above, Peru and Trinidad and Tobago export most of their production via LNG. In the case of Bolivia, it also has a marked export profile, but it does so via gas pipelines to Brazil and Argentina.”

Source: BP, GIIGNL, Enargas, ANH Bolivia, CNE Chile, ARPEL.

As can be seen in the table above, Mexico, despite being a great producer, imports most of the gas it consumes by gas pipelines from the US. “Brazil, given that its production is mainly of associated gas in offshore deposits, can’t create much leverage,” and it re-injects gas mostly to the subsoil, and is a large importer via gas pipelines and LNG,” ensures Ferragut, who points to Argentina as the “most mature and complex” gas market, mainly due to a large transport and distribution network that reaches the main cities of the country. “Not surprisingly, 50% of the energy matrix in this country is fed with natural gas, rating one of the highest worldwide.” Other countries where gas consumption is deep-rooted are:

- Colombia, with lower volumes, but great territorial coverage.

- Brazil, with a more industrial consumption profile.

- Mexico, where industrial uses and electricity generation also predominate.

- Bolivia, with a great stimulus from the State.

- Chile, which, despite not being a great producer, has a fairly developed market.

- Peru, more recently, but seeking to widen the use of gas.

- Trinidad and Tobago, with a very particular profile, since in addition to being a large producer and exporter, the main domestic use of natural gas is its industrialization for exports in the form of ammonia and methanol, followed by the generation of electricity, which in this country is 100% powered by natural gas.

As for the rest of the Latin American countries, gas consumption is usually intermittent and associated with the generation of base or backup electricity, with less distribution infrastructure and, therefore, without so much tradition in the population or production sectors.

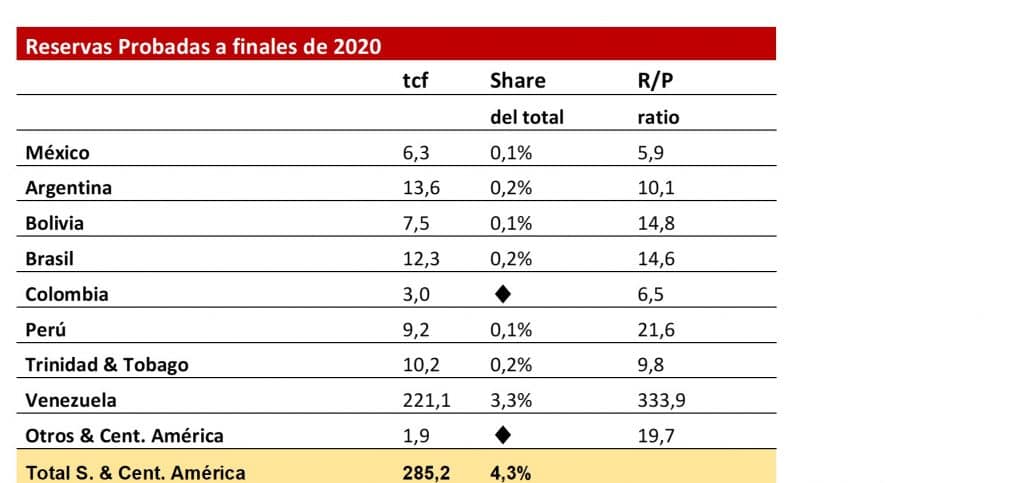

Source: BP

As for proven natural gas reserves in the region—a reference document for the energy sector—there are 285.2 trillion cubic feet in Latin America and the Caribbean (as can be seen in the table), representing just over 4% globally. More than three quarters of that gas is found in Venezuela. “A somewhat more palpable reference is the reserves-to-production ratio,” Mr. Ferragut explains, “which tells us how many years the current demand could be satisfied, with the level of existing proven reserves. From this point of view, most countries exceed 10 years, which can be considered a good level of reserves if the exploratory effort is maintained. The most exposed countries would be Colombia and Mexico, although exporter countries Bolivia, Trinidad and Tobago and Peru would also need to make a greater exploratory effort in order to sustain or even expand their exports.”

Gas infrastructure network

As indicated by ARPEL, there is a very unequal development of gas infrastructures in Latin America; while countries such as Brazil or Argentina have a consolidated production, consumption and marketing network, there are others such as Paraguay, Suriname, Guyana, or most of Central America and the Caribbean, which have no infrastructure, and therefore do not use natural gas in their matrix. There are two liquefaction plants for LNG terminals: Atlantic LNG in Trinidad and Tobago with a total capacity of 14.80 MTPA (million tons per annum) and Pampa Melchorita in Peru with a capacity of 4.45 MTPA.

There are also more than 20 regasification terminals at present, with a total capacity of around 70 MTPA; distributed in Brazil, Argentina, Chile, Colombia, Panama, Mexico, Jamaica, Dominican Republic and Puerto Rico—with Ecuador, El Salvador and Nicaragua expected to join this list soon.

“In general terms, I also believe that there are many possibilities for developing infrastructure based on different drivers. In the case of Central America and the Caribbean, the main driver should be to replace imported fuels and other pollutants with LNG for generating electricity. In the case of Suriname and Guyana, the use of gas discovered in offshore deposits, both for electricity generation and for industrial development, sounds interesting. In Brazil, further development of LNG could be expected, as this is what provides flexibility to the electrical system, which, by the way, is now suffering from extensive drought that has strongly affected hydroelectric generation and, as a result, has also affected the thermal back-up needs,” assures the Gas Committee Coordinator, who adds that “some uses of gas begin to be more competitive, in particular for long-distance transportation, whether fluvial-sea or land, which is why it is possible that in the coming years we will see a greater development of port reloading infrastructure and for trucks powered by LNG/CNG.”

The most important international channels are those that join Bolivia’s systems together with Brazil and Argentina. “There are two gas pipelines between Bolivia and Brazil; the main one is the TBG system, with a transport capacity of 30 million m3/d and an extension of 3,150 kilometers,” ARPEL indicates. Argentina, for its part, shares three gas pipelines with Bolivia (with a total capacity of almost 25 million m3/d), and seven with Chile, which cover more than 5,000 kilometers of border on the Andes Mountains. “These infrastructures bring countries together in the north, in the center at the level of Santiago in Chile and in the south at Tierra del Fuego; with a total transport capacity of almost 40 million cubic meters per day.” In 2020, according to Enargas data, flows were recorded for five of these gas pipelines. Argentina is also connected to Brazil and Uruguay.

With regard to national transport systems, the most developed countries are Argentina, Bolivia, Brazil, Colombia and Mexico.

Future outlooks

As indicated by ARPEL, the biggest projects within the sector are being carried out in the field of LNG. “Brazil added two regasifiers to the three it already had, and it has several projects in the pipeline. Colombia is seeking to develop a second structure in the Port of Buenaventura in the Pacific, although the tender opened in October 2021 has been dropped, so there is uncertainty about what will happen with that project,” they assure. Countries such as Jamaica, Panama, El Salvador, Nicaragua or Ecuador have installed infrastructure for importing LNG, which will be operational before 2022, and the Mexico region is also in the development phase.

From the point of view of gas pipelines, the Latin American association points out that the most interesting projects will be carried out in Argentina and Brazil. “The first, after increasing its production due to the development of Vaca Muerta, seeks to channel its greatest production, both to ensure domestic demand and to place volumes in neighboring countries, Brazil being the most attractive destination. There are several options for achieving greater integration, optimizing gas flows and generating benefits for both countries, such as reinforcing the infrastructure that connects Vaca Muerta in Neuquén with the center and north of the country, integrating both countries through Bolivia, making use of the idle transport capacity.”

“In general, I believe that the clearest perspective is that the world is in the process of decarbonization, with strong pressure from the international community to accelerate this transition, in which natural gas has a clear role to play and Latin America has great opportunities,” Mr. Ferragut points out. Among the major trends in the region, indications point to LNG, which more countries are expected to include in their imports and there have been capacity increases, mainly in Brazil. “Today we are going through times of great uncertainty in the energy markets, not only because of what moving on from the global crisis caused by the pandemic poses, but also because of the rapid technological evolution that new competitors are bringing to the markets, as well as new ways of using natural gas in small and microscale applications. I believe that, in order to reduce that uncertainty, comprehensive planning is necessary to allow for clarity on the direction that each country will take, and which can establish the conditions that investors and the finance sector need for the development of projects, seeking to make the transition fair and cost-effective,” he concludes.

This article was written with the collaboration of…

This article was written with the collaboration of: Pablo Ferragut, an economist and expert on energy, climate, energy transitions, and corporate sustainability, with more than 10 years of experience in the energy sector, most of which were spent working in international cooperation in Latin America and the Caribbean.

This article was written with the collaboration of: Pablo Ferragut, an economist and expert on energy, climate, energy transitions, and corporate sustainability, with more than 10 years of experience in the energy sector, most of which were spent working in international cooperation in Latin America and the Caribbean.

He currently works as a project manager at ARPEL (Regional Association of Companies in the Oil, Gas, and Biofuel Sector in Latin America and the Caribbean), as head of the Sustainable Management and Natural Gas Area.