Julia Maria Gomez de Avila Segade | 21/03/2023

Since the end of the COVID-19 pandemic, the Brazilian economy has shown significant growth, with relatively low inflation compared to the world’s largest economies. This situation has created good growth prospects for the insurance market in 2023, despite the fact that competition in the global risk market is very concentrated, because it is a very specialized line of business.

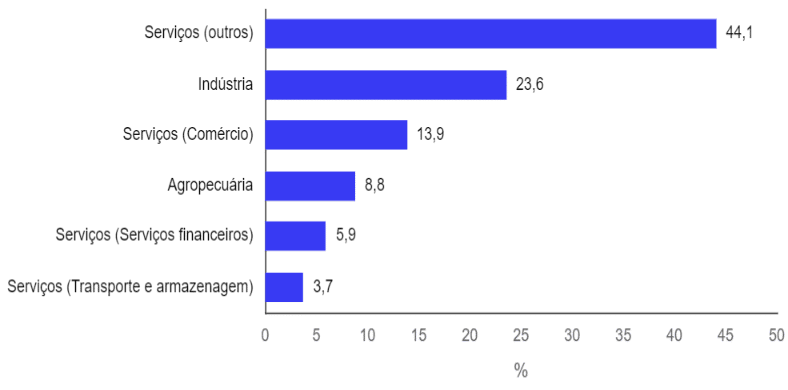

Brazil’s GDP make-up is based on three major sectors of the economy:

Primary: Agriculture, livestock, mining and extraction.

Secondary: Transformation industry, textiles, food, metallurgy, chemical/petrochemical, pharmaceutical, etc.

Tertiary: Tourism, services, hospitals, finance, transportation and communication.

Participation in GDP

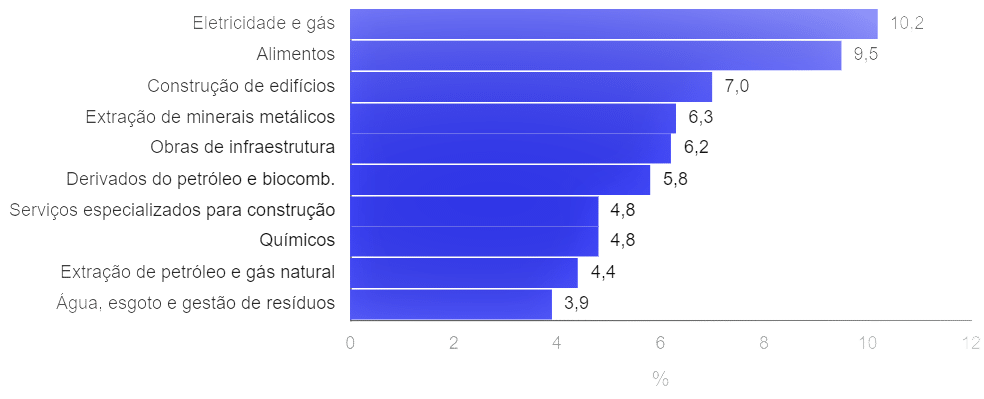

The Industry sector is subsequently compared to the rest of the economic activities – 2021 (%)

Note: Other services include tertiary activities

Industrial participation in GDP

The top ten sectors of Industry – 2020 (%) are shown below

Please note: Industriabrasileira : Cepea ; ibge

The industrial sector represents 23.6% of GDP. Construction, power generation, chemicals/petrochemicals, food and agribusiness, steel, pharmaceuticals, road concessions and airports, are all examples of good opportunities in the insurance market.

It is important to point out that just the production chains of agribusiness (23%), oil extraction (13%) and mining (6.3%) together represent approximately 42% of national GDP.

The Brazilian market has many corporate insurance companies; it is very competitive. There are large capacities for automatic contracts and facultative reinsurance, but we understand that, as Brazil is a market with a diversified and dynamic economy, and with low exposure to catastrophe, there could be opportunities in origin risks. The fact should not be ignored that several multinationals are already present in the industry segment.

Transport

As the first insurance sector to feel the economy accelerating, this showed strong growth in 2022. In that year, the market saw continued strong competition being established with new companies.

Marine Hulls

With the recovery of the economy, an increase has been seen in the movement of vessels for the transport of goods in Brazil. Likewise, the Oil & Gas sector also increased its presence.

Aviation

This sector had a strong impact on GDP growth in 2022 thanks to the acquisition of new aircraft. Demand in the executive aviation segment was very high and today there is a long waiting list for the purchase of new aircraft from the United States and other countries.

With the increase in agribusiness in recent years, in 2022 there was also a notable increase in the acquisition of agricultural aircraft.

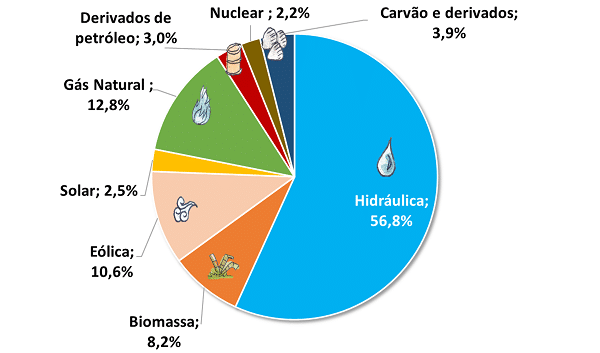

Renewables

EY Global Renewables Renewable Energy Attractiveness Index (RECAI) drives investment in renewable energy in different countries. In the ranking prepared in November 2022, Brazil ranks 14th, maintaining its position as the leading Latin American market for investment in renewable energy.

The country is clearly promoting the theme of the planet’s sustainability through wind and solar energy, but it is also paving the way with hydrogen. Last August, the Department for Green Hydrogen was created to boost its growth and agreements are being signed, such as that in the state of Ceará, as its ports are closest to Europe, and principally exports will be encouraged.

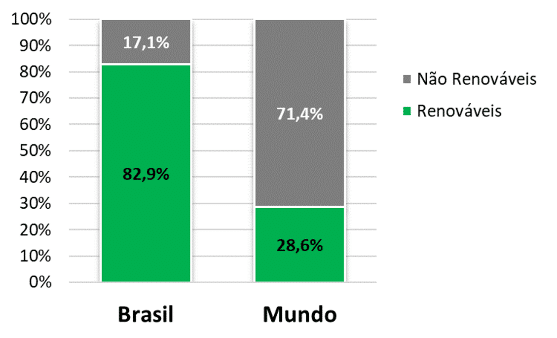

In Brazil, the most widely used energy sources are from renewable resources. According to 2021 data from the Government Energy Research Company (EPE), hydroelectric power, which is the main basis of its electricity generation, accounts for about 56.8% of the electricity consumed in Brazil.

In its energy matrix Brazil uses about 82.3% of renewable sources, while the global average is 28.6%.

As we said at the start, the outlook for the Brazilian market is very positive and it also has a wide range of opportunities in the global risks sector.

Our collaborator is…