Cristina Leon Vera | 13/02/2024

After reaching a historic foreign direct investment volume in 2022, Uruguay faced an unprecedented drought in 2023 that caused a slowdown in the first half of the year, which, despite the impact, ended with economic growth of 1.3%.

Despite not being a region regularly subjected to water scarcity, from late 2022 to mid-2023, the Uruguayan government declared successive water crises in both the agriculture and livestock industries and in the metropolitan area of large cities such as Montevideo. The Development Bank of Latin America (CAF) then pointed out that insufficient hydraulic infrastructure was the main trigger of this situation, a lack that, masked by the heavy rainfalls that are common in the region, had already been revealed by the Inter-American Institute of Cooperation for Agriculture in 2010.

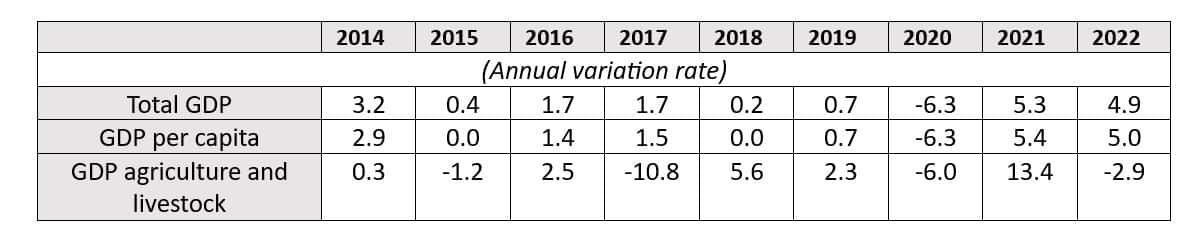

This situation directly impacted economic development, as droughts disrupt livestock, the country’s main activity (more than 90% of livestock production in Uruguay is based on the grazing of native grasslands, which make up the majority of the territory’s land area). Despite having grown in consecutive years after the pandemic (5.3% in 2021 and 4.9% in 2022), there was a slight decrease in GDP in 2023 (1.5% according to World Bank data) amid an economic expansion. This was due to the support of strong macroeconomic management and favorable external conditions, which the company said will return to 3.2% growth in 2024.

Growth Spring

In the latest economic report developed by the Economic Commission for Latin America and the Caribbean (CEPAL) published in 2023, following the slowdown caused by drought and global recession, the Uruguayan economy has once again been energized by industrial export activity. The main highlights are cellulose and the increase in household consumption caused by the recovery of real salaries and employment. In this context, an average growth of 3.1% per year is forecast for the 2024-2027 period, slightly above the potential growth. Relatively, its middle class is the largest in the Americas and represents more than 60% of its population.

According to the latest report published by ICEX (Instituto Español de Comercio Exterior [Spanish Institute for Foreign Trade]), the main aspects of the international context that negatively impacted the commercial development of the region were:

- Effects of adverse shocks from the pandemic and the invasion of Ukraine.

- Inflationary pressures involving restrictive central bank monetary guidance.

- Trade disorders caused by post-war geo-economic fragmentation.

On the other hand, the reopening of activity in China and its momentum partially offset these factors that pushed international trade down. In this context, Uruguay is obtaining record foreign investment figures.

The industries that receive the highest percentage of this investment are:

- Manufacturing Industries

- Trade

- Insurance and Financial Activities

- Professional, Scientific and Technical Activities

A favorable context for energy development

In March 2023, CEPAL published the study “Energy poverty in Uruguay – Diagnosis of gaps in equitable access to quality energy”, which states that, in addition to the high degree of access to electricity in the residential industry and the high total supply of primary energy per capita to supply different production activities, Uruguay is one of the countries with the highest rate of energy efficiency. In addition, it is conducive to the implementation of environmental policies, although it is still responsible for a large percentage of CO2 emissions, so the region is immersed in making significant efforts.

According to the latest data posted by the National Energy Balance (Balance Energético Nacional, BEN), Uruguay managed to have an electricity generation matrix composed of 97-98% renewable energy between 2017 and 2019.

In 2021, electricity generation grew by 18% compared to the previous year and export grew by 148%. The recovery in economic activity and the strong drought positioned the region as a large producer, although the presence of renewable sources was reduced to 85%, mainly due to the low hydraulic production and the entry into operation of thermal power plants to export energy to Brazil.

In 2022, the main energy sources that allowed for sourcing were:

- Petroleum derivatives (43%)

- Biomass (39%)

- Hydraulic (9%)

- Wind (7%)

- Solar (1%)

According to Uruguay XXI, an agency responsible for promoting exports, investments and the overall image of the country, Uruguay faces a new energy transformation with the challenge of reducing the total consumption of fossil sources, which is currently at 40%, with a high incidence in the transportation and industrial sectors. More than half of the region’s carbon dioxide emissions originate from burning fossil energy.

The main objectives of this phase are:

- Direct electrification of end uses

- Developing a settled green hydrogen economy

- Consolidating a smart grid to efficiently coordinate energy supply and demand

- Expanding the possibilities of generation from agricultural waste

- Advancing energy valuation of urban solid waste

- Incorporating clean energy into the transportation industry, applying the latest available technologies