Cristina Leon Vera | 27/02/2024

With economic stability prospects, marked by private consumption, and with the objective of continuing to expand its trade and international projection, Nicaragua faces the challenge of strengthening its renewable energy scheme and continuing to create quality employment.

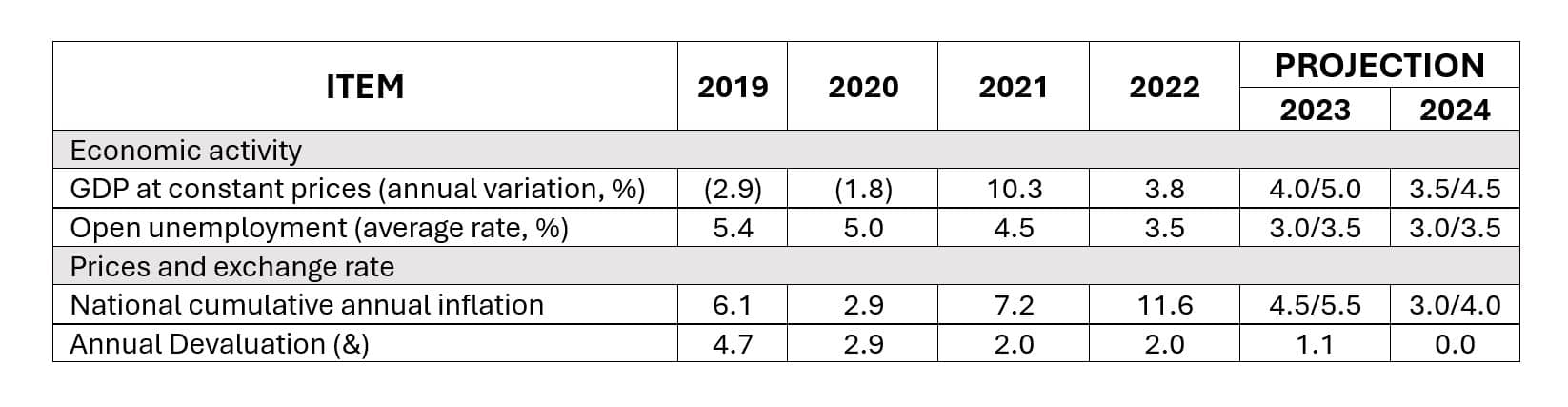

According to the latest report published by the Central Bank of Nicaragua (Banco Central de Nicaragua, BCN), which addressed its economic situation at the end of 2023, the country is in a moment of sustained economic growth and has managed to maintain internal momentum despite the context of a global slowdown. The latest data collected on the evolution of GDP, obtained in 2023, speaks to growth of up to 3.8% driven mainly by hospitality and tourism, mining, energy, trade and construction. This scope was especially determined by domestic demand, but also dampened by the decline in net external demand.

Stable economic outlook

The data from the Monthly Economic Activity Index (Índice Mensual de la Actividad Económica, MAE) reflect, in the second half of 2023, a cumulative growth of 4.5%, which pointed to a good pace of economic activity in the remaining year. These good prospects were accompanied by signs of a gradual slowdown in inflation, which was 6% year-on-year in October. The outlook for 2024 is even lower, based on a decrease in international inflation and a positive internal policy framework.

By 2024, the BCN projects economic activity growth between 3.5 and 4.5%, which would be accompanied by stability in the labor market, maintaining an unemployment rate of less than 3.5%. According to this institution, the economic benchmark of the region, Nicaragua has shown internal strengths that help in risk mitigation and promote constant growth. One of the most important is the degree of openness to the rest of the world, which has motivated the growth of the revenue generated by the foreign sector, fundamental to Nicaraguan positioning.

Supporting a stable exterior industry

According to official figures published by the Nicaraguan government, in the first half of 2023, gross revenue from direct foreign investment (DFI) amounted to $1,447 million, 28.9% of the volume registered in the same period of 2022. This was primarily due to higher intercompany loan disbursements. Total DFI then accounted for 17.3% of GDP, up 4.9% from 2022.

The main source of financing in the net flow of the DFI was the reinvestment of profits, with $476.8 million in the first half of 2023, a lower figure by $72.2 million than the one registered in the same period of the previous fiscal year. The industries that generated the greatest profit reinvestment were:

- Manufacturing industry (mainly companies under a free zone regime)

- Trade and Services

- Financial Services

- Mining and Energy

- Telecommunications

The engines of the Nicaraguan economy

As reflected in the latest ICEX economic and trade report, Nicaragua is a historically agricultural and livestock country. The primary sector contributes about 16% of the region’s GDP and employs more than 30% of the population. Its territory has 3.6 million hectares of great fertility, of which 67% are not being used, so there is a very significant growth potential. The crops intended for export are mainly coffee (15% of total exports, worth $438 million), sugar, peanuts, bananas and raw tobacco.

The secondary sector also provides a bright outlook for the region. Mining, which accounts for around 5% of GDP today, has been consolidated in recent years as a key to Nicaragua’s economic momentum, thanks to higher international demand for minerals and high raw material prices that led to an expansion of activity. In addition, the industry represents 13% of the GDP, supported by agribusiness and accompanied by others such as textiles, chemicals and the rubber industry.

For its part, and as we have noted at the beginning of this article, the profit obtained by the tertiary sector remain the key component of GDP in the region (53% in 2023), where, according to ICEX, low-complexity services prevail. The main activities in this area are:

- Trade (11% of GDP), one of the activities most affected by the crisis

- Construction and Housing (6% of GDP)

- Teaching (6% of GDP)

- Transportation and Communications (5% of GDP)

- Financial Services (4% of GDP)

Energy Landscape

The country’s electricity coverage is currently 95.6%. One of the initiatives that the Nicaraguan energy landscape is setting is the National Sustainable Electrification and Renewable Energy Program (Programa Nacional de Electrificación Sostenible y Energía Renovable, (PNESER). The objective is to raise the rate of electrical coverage in the region to give the population access to efficient and sustainable service. The seven guidelines outlined by this project are:

- Rural Electrification by Network Extension

- Standardization of the Service in Settlements

- Expansion in Isolated Areas with Renewable Energy

- Pre-investment and Study of Renewable Generation Projects

- Energy Efficiency Programs

- Reinforcement of the Transmission System in Rural Areas

- Sustainability of ENEL’s Isolated Liability Systems