Despite the onslaught of the pandemic months in Colombian society and industry, and therefore in the electricity sector, the region optimistically faces the beginning of the recovery and an energy transition that, with the support of technological progress, will have a very positive impact on the country’s economic development. Christian Jaramillo, director of the Colombian Mining-Energy Planning Unit, tells us about the situation in the sector and the main challenges it faces today.

In the global search for a sustainable energy model for the coming years, Colombia is facing the energy transition from a privileged place in order to be the leader of this process in Latin America. As Christian Jaramillo, director of the Mining-Energy Planning Unit (UPME [Unidad de Planeación Minero-Energética]) reveals to us, this is the path towards a decentralized, digitized, and decarbonized electricity sector. “The country has world-class renewable natural resources, and a market environment conducive to investment and development of these resources that together would allow it to make progress in replacing polluting fuels”, he says. Moreover, and as explained to us from this institution attached to the Ministry of Mines and Energy, “there have been signs of public policy to encourage the development of new sources of clean energy generation, as well as the adoption of energy efficiency technologies, intelligent measurement, and transportation of low emissions”, which encourage both consumers and the business fabric to commit to these new technologies and, with them, optimize energy use, improve the competitiveness of companies in the sector, and mitigate the environmental impact.

Although water-based energy is essential for the region, Colombia’s potential in the renewable field is indisputable, especially in solar and wind energy, which are currently a reference in the region. “We currently have 18 GW installed, of which 68% is hydro, 30% is thermal, 1% is unconventional renewable and the remaining 1% is in other sources. On the other hand, there are approved connections for more than 18 GW, of which about 13 GW are non-conventional renewables, that is: 10 GW in sun and almost 3 GW in wind. However, it should be taken into account that the most recent regulations established obligations in such a way that their non-compliance entails the loss of the connection point and the release of this capacity, which may be assigned again later. However, the figures for projects with approved connection and commitments to the electricity market add up to 3.3 GW in renewables: 2 GW in wind and 1.3 GW in solar,” explains Jaramillo.

Relevant challenges

In recent months, both the sector and the region have been immersed in a delicate situation that has tested the country’s network of electrical infrastructures. On the one hand, society has faced a social and health crisis derived from the COVID-19 pandemic, with a negative impact on the economy. In 2020, GDP growth was -6.8%, which was the lowest historical record since that statistic was recorded in the country. The energy sector was therefore hit. “Due to the restrictions on mobility and crowds, the demand of the main energy sectors was drastically reduced in April and May 2020 – months with the greatest restrictions – and, as economic activities have been opening, demand has been recovering”, states Jaramillo. In 2020, electricity dropped by 2% compared to 2019, an event that had not occurred since the 2000 crisis. In turn, natural gas fell by 3.26%, where the sectors that reduced their consumption the most were tertiary, oil, and transportation. “Today we can see that demands have recovered and are already at higher levels than those recorded before the pandemic, with which the reactivation of the Colombian economy is observed thanks to the opening of the productive sectors and the progress in vaccination.”

Another of the pressures suffered by the sector in recent months is that 70% of the installed electricity generation capacity is concentrated in water resources, a high level of dependence. However, one of the aspects that has recently affected the country is drought, which has forced it to increase backup thermoelectric generation and import electricity from Ecuador. At the UPME, they believe that the region is not in an extreme situation. “The level of reservoirs is 84%, which allows us to meet the current demand and have reserves for the coming summer. Between 2023 and 2024, the hydro ratio will change with the incorporation of thermal and renewable projects committed to the electricity market. The hydro portion will be close to 60% and the renewables portion will be 13%”, assures its director.

UPME Perspectives

| 2021 | 2023 | 2034 | |

| Hydro | 68% | 59% | 49% |

| Thermal | 30% | 27% | 23% |

|

Unconventional Renewable Energy Sources (FNCER [Fuentes No Convencionales de Energía Renovable]) |

1% | 13% | 21% |

For the implementation of this power generator, Jaramillo explains that “the Expansion Plan, through the optimization of investment and operation costs, analyzed five scenarios in order to identify capacity requirements additional to that committed through auctions of the load by reliability, long-term contracting, and through expansion guarantees. The results show that, in the most demanding scenario, which determines the use of resources, in 2034 at least 6 additional GW to those already committed will be required, of which 5 GW are expected to be unconventional renewable (sun and wind).

Sector challenges and opportunities

Currently, 22 national and regional transmission works, awarded by public call, are being executed. Although all of them are fundamental for meeting demand, sustaining service continuity and reducing cost overruns due to restrictions, UPME highlights “works such as the 500 kV reinforcement to the Caribbean, the battery in Barranquilla, which is the first project of this type in Colombia, and others for the Central East area (Cundinamarca and Meta), which are decisive for a region that consumes 25% of the country’s demand”.

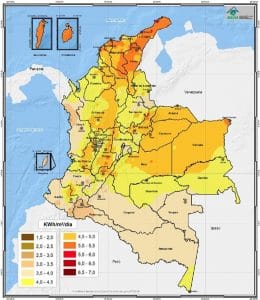

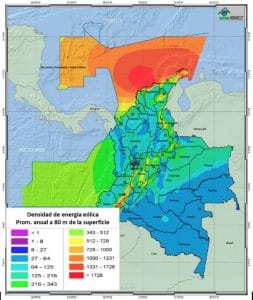

In terms of potential, the wind resource is concentrated in La Guajira and part of Magdalena, Atlántico, and Bolívar. There is also a potential for offshore in the region, for which a roadmap has been developed. For its part, the solar potential is more distributed in the national territory. Both can be consulted in the Atlases available on the UPME website.

Another fundamental part of the industry is the work of the transportation chain, which is essential for guaranteeing attention to demand, service continuity, reducing cost overruns due to restrictions, and connecting users as generators and large consumers. “The planning exercise is continuous and allows us to continue identifying needs and deficiencies, and with it new works. However, included among the improvements to the process is the anticipated planning and the longer-term vision, so that these infrastructure changes arrive on time and are opportunities, not reactions”, Jaramillo points out.

Despite the room for improvement, the UPME insists that the level of the electricity sector is very high, although it always seeks to promote change as part of that gear that a country’s economy requires for its operation and level of competitiveness. “The limitations that are identified over time due to obsolescence, lack of space, market and network management, etc., lead to the development of new technological solutions, even in the electrical infrastructure itself, and proof of this are the recent electronic valves that allow flows to be managed in the network and avoid overloads or other problems”, they say. Some of the major processes that have been successfully implemented into the value chain are batteries, which have important uses not only in storage, but also in supporting network variations or problems. “Flexible Alternating Current Transmission Systems (FACTS) based on electronics, remote monitoring for measurement and operation, intelligent and unattended substations, and many others, are some of the trends that could more be more closely tied to IT, management of consumer decisions, and distributed generation, taking advantage of renewable resources”.

With regard to the role that the energy sector will play, and specifically the renewable sector, on the economic, social, and competitive development of Colombia, at UPME they are clear that it will not only be fundamental in the environmental field, but will become a pillar to support the effects of climate change on the water component, which can lead to supply security and price stability, as well as provide a service under decent conditions to the households in the region. “To conclude, it is worth noting that the technological progress aimed at decarbonizing energy consumption focuses on electrification. The use of electricity in sectors such as transportation, industry, and other applications in which fossil fuels are used today will result in a substantial increase in energy demand. As a result, the generation and transmission capacity should increase accordingly to not only sustain the growth in usual demand, but also the consumption from new sectors”, concludes Christian Jaramillo.

Article Collaborator:

Christian Jaramillo studied Physics and Mechanical Engineering at the Universidad de los Andes, and has a master’s degree and doctorate in Economics from the University of Michigan in Ann Arbor.

Christian Jaramillo studied Physics and Mechanical Engineering at the Universidad de los Andes, and has a master’s degree and doctorate in Economics from the University of Michigan in Ann Arbor.

With over 20 years of experience in the public and private sector, he has been assistant director of the National Administrative Department of Statistics (DANE [Departamento Administrativo Nacional de Estadísticas]) and director of Organizational Management at the National Directorate of Taxes and Customs (DIAN [Dirección de Impuestos y Aduanas Nacionales]).

In the energy sector, he was an expert commissioner of the Energy, Gas, and Fuel Regulation Commission (CREG [Comisión de Regulación de Energía, Gas y Combustibles]) and executively managed that company from July 2018 to January 2020. Jaramillo has also worked as a professor in the Faculty of Economics at the Universidad de los Andes and is currently a professor at the Universidad del Rosario.

The Mining-Energy Planning Unit (UPME) is a technical unit attached to the Colombian Ministry of Mines and Energy, and as a planner it has several responsibilities related to the generation of electricity, transportation networks, and service coverage, among others. On the one hand, it is responsible for preparing the Expansion Plan, which, in terms of generation, determines the additional capacity that the country requires and the mix based on available resources; however, it does not establish the projects to be executed as generation is a free initiative activity. Additionally, in terms of national transmission, it identifies needs, deficiencies, and defines projects. In order to execute the transmission projects, investors are selected through public call processes, also managed by the UPME.

Likewise, this Unit is in charge of the indicative Coverage Expansion Plan, which identifies households without service and the possible solutions, among them, which are interconnectable, in which cases it is worthwhile to create a micro-grid and which are definitively individual solutions.