admin | 30/06/2020

The steel industry in Latin America has been fighting for years to stay competitive in a context of commercial uncertainty and economic slowdown in the region’s leading economies. The emergence of the coronavirus pandemic has opened a new gap that the line hopes to bridge by implementing technology, committing to sustainability, and cooperating regionally to develop value chains that enable the sector to bounce back.

Prior to the health crisis caused by COVID-19, the steel industry was seeking to promote productivity and development during the economic downturn, struggling with the consequences of the lack of stimulus and updated public policies to tackle the economic problems in the region. According to Latin American Steel Association (Alacero) General Manager Francisco J. Leal, in late 2019 sector performance showed a worsening in the deindustrialization process, with a new year of challenges for the local economy on the horizon. “Regional steel consumption, which has been decreasing gradually since 2014, also dropped last year as a result of the economic downturn in the leading Latin American economies, in addition to the global slowdown context, lower prices on basic products, and commercial disputes with partners,” he explained.

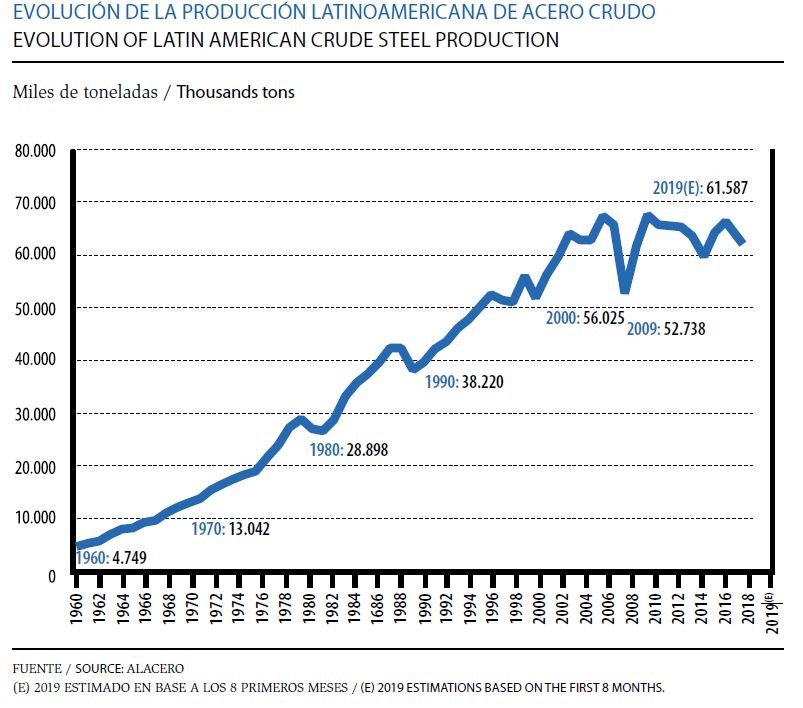

Over the past seven years, growth had already been very slow in Latin America and the Caribbean, but with the pandemic, the economic forecasts are “discouraging.” The Economic Commission for Latin American and the Caribbean (CEPAL) is predicting a 5.3% decline this year. If that is true, it would be the worst economic recession since 1930, when it decreased by 5%. In Latin America, one of the most immediate effects of the health crisis is the decline in steel production. This decrease reflects the overall low demand and the halt in operations as a result of the downturn’s impact. In a strategy that seeks to balance supply and demand, some plants have shut down their furnaces. “In April and May of this year, seven furnaces have shut down due to COVID-19, with a combined capacity of nearly 7 million tons. In April, the figure for Latin America in sheets was -2.9 Mt: a number that had not been seen since January of 2009,” noted Francisco J. Leal.

High Competitiveness

The risk of a slow recovery would mean a possible stop to operations and a loss of jobs, predicted Leal, who believes that this situation will remain the same through the third quarter. In this situation, steel imports at dumping prices threaten to cause even greater damage to the industry in Latin America.

“Latin American steel companies are in favor of competition and open trade, but under equal conditions for all,” the Alacero general manager said. The loss of competitiveness in recent years is associated with the high cost of the domestic market and unfair competition. In the last quarter of 2019, the number of antidumping lawsuits increased from 66 to 75, with 50 of them against China.

Still, Francisco J. Leal believes that Latin American steel is competitive and is operating in accordance with world-class standards of governance, environmental quality, and safety. Because of this situation, all economies in the region agree that the only way to create quality jobs and the development needed is to guarantee a solid foundation for the sector, which is leading countries to work together through free-trade treaties that are promoted from within their territory—such as Mercosur—as well as individual treaties, such as the one under negotiation between Mexico and Ecuador, for example. “In addition to all of that, Alacero is leading efforts to promote the values of integration and network building, bringing together major associate companies, such as Arcelor Mittal, Ternium, and Gerdau, as well as other big names in Latin America,” he stated.

In the long term, the health crisis may be beneficial, such as in the acceleration of large-scale usage of technology 4.0 and decarbonization, as well as in the quick, safer construction of sustainable steel, as in the field hospitals built in record time. “Steel is involved in a number of value chains that are essential, such as transportation, oxygen supply, national security in each country, infrastructure, food and disinfectant storage, white goods, and others that are essential today in this crisis,” mentioned Leal, who sees the opportunity to move beyond the crisis as a more streamlined, profitable, and sustainable sector with better safety protocols for workers. “It is part of the solution and contributes responsibly to caring for the environment and for the social and economic development of the communities where it operates,” he said.

In the long term, the COVID-19 crisis could be beneficial, accelerating the large-scale use of technology 4.0 and decarbonization.

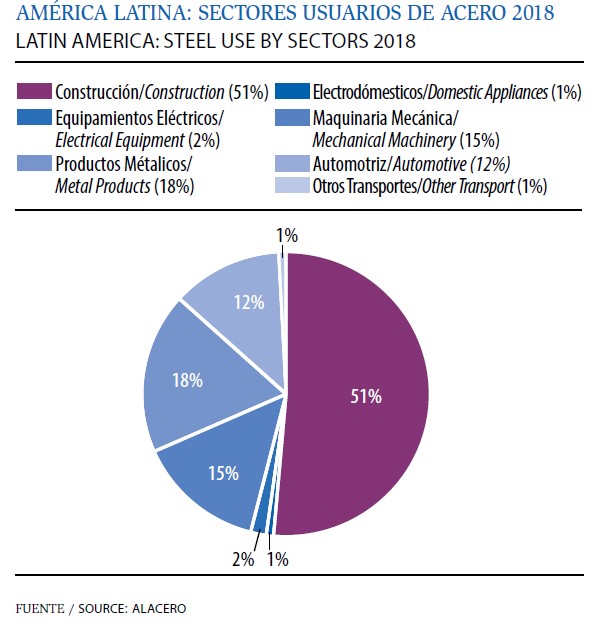

However, this branch is one of the pillars of the Latin American economy, as it serves as a foundation for many other key areas for the future of society, such as construction, energy, and infrastructure. “In Latin America, the steel industry is indispensable, and its significant importance can be seen through its influence in other activities,” the Alacero executive acknowledged. Its impact is reflected in the numbers of the region’s three largest economies (Brazil, Mexico, and Argentina), where its production represents 13% of the GDP: a significant share when compared to the most recent weighted average of 12% established by the World Bank.

Innovation for Prosperity

To develop the sector even further in Latin America, companies are turning eagerly toward innovation, with new practical applications in place based on advances related to digitization. For example, there is the implementation of artificial intelligence (AI) algorithms that can predict potentially severe accidents in specific parts of operations, such as the mill crane in the presence of liquid steel. It is also possible to analyze images taken by autonomous drones to monitor the status of tall structures, detecting areas in need of repair. The work of these robots reduces the need for people to conduct high-risk activities at the plant, eliminating hours of repetitive work and increasing process productivity.

The steel sector is one of the pillars of the Latin American economy, a foundation for other key industries for the future, such as construction, energy, and infrastructure.

Francisco J. Leal is also satisfied with the measures applied to save energy, including reducing the size of the steam distribution network and decreasing electricity consumption. “Due to its developments in the use of technology to tackle problems related to the environment and safety, the steel industry has acted as a guide in inspiring even more innovations in other areas,” he revealed. He expects to see benefits in the branch through the future exploration of augmented reality solutions and robotics.

The industry’s commitment to technological advances is evident in the fact that 38% of all steel companies in the region are now using Internet of Things (IoT) solutions in environmental systems, and 56% apply different techniques to face the challenges related to the ecosystem and safety, according to a survey conducted by Alacero’s Technology and Environmental Control Committee (Cotec) with the leading companies in Mexico, Brazil, Argentina, Chile, Colombia, Ecuador, Peru, and the Dominican Republic. Cloud computing is also used by 40% of all steel companies, with cybersecurity technology applied by 25%. To address the problems associated with biosystems and safety, 20% of them are now using augmented reality (AR) and 25% use Big Data/Analytics.

“The progress resulting from the application of technological innovation has led to more sustainable horizons for the future of the industry and society,” said Leal, referring to the International Energy Agency (IEA), which has been working for over 40 years to help the sector define a safe energy future, opening its doors to the major emerging nations in 2015, and cooperating with associations to define the technology map for a more sustainable steel industry.

Evolution of Latin American raw steel production

Latin America: steel-consuming sectors in 2018

This article was written with the participation of…

Francisco J. Leal has over 25 years of experience in steel processes and sales. He has been the general manager of the Latin American Steel Association (Alacero) since 2018. Prior to that, he held a variety of positions of responsibility in companies such as Vitromex, Walmi Transforma, Grupo IMSA, and Ternium.

Francisco J. Leal has over 25 years of experience in steel processes and sales. He has been the general manager of the Latin American Steel Association (Alacero) since 2018. Prior to that, he held a variety of positions of responsibility in companies such as Vitromex, Walmi Transforma, Grupo IMSA, and Ternium.

Leal is a chemical engineer from the Autonomous University of Coahuila, with a master’s degree in business administration, specializing in supply chain management, from Tecnológico de Monterrey. He is also certified in finance by the ITESM, strategic thought and business vision by Harvard-IPADE, Supply Chain Management and CPIM by APICS, strategic thought and key accounts by the University of San Diego, and lobbying and institutional relations by EGAP-ITESM.