Julia Maria Gomez de Avila Segade | 19/10/2022

MAPFRE participated in the Swiss Life Network Annual Conference, which also celebrated its 60th anniversary.

Life is the network that offers global solutions to multinational companies. We’re talking about insurance benefits for employees, from health insurance and life insurance to the ability to save periodically for retirement.

Among its 90 members, MAPFRE’s presence was essential, as it represents Swiss Life in 20 countries. Representatives from most partner insurance companies, as well as representatives from multinational clients of the network, attended the meeting.

These benefits are critical nowadays, because they not only serve as an incentive for employees, but they also put the company at the forefront of the market, making a difference among other employers. For the worker, these benefits increase motivation and well-being, thus generating greater commitment and productivity, and the fact of having easy access to health care – not only for them but also for their immediate family members – relieves some of their stress.

For the company, in addition to having tax advantages in some countries that allow for deductions on part of the investment in its human resources, these social benefits enable the company to recruit and retain talent – key to the success of any company – and generate greater productivity given the increase in commitment, but also thanks to the medical assistance that results in less sick leave, and therefore a reduction in costs to the company.

This market conference covered current topics of international employee benefit programs, such as using wearable devices to improve the underwriting work of life insurance policies, or employing methodologies and services to increase the well-being of employees of multinational companies.

Analyzing the overall computation of the data, the report reflects that both exogenous and endogenous factors have been crucial for the numbers of contagion and mortality to have been one or the other

MAPFRE participated in the Roundtable discussions on the impact of COVID-19 in terms of demographics and the insurance world, and shared its experience with the South African insurer Momentum about how best to respond to such a deep and severe crisis situation.

Fernando Gómez Guerrero, responsible for developing the Global Employee Benefits Programs at MAPFRE, was the speaker who presented quantitative data to an audience of 100 professionals and customers that recalled the severity of the pandemic on the human and corporate level, and whose graphs showed the different waves and also the undeniable efficacy of the vaccine.

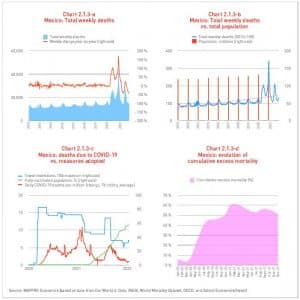

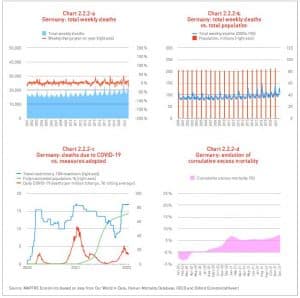

The speaker used data from Mexico and Germany as a reference for representing the maximum and minimum virulence, respectively, provided by MAPFRE Economics and Fundación MAPFRE in their report entitled “COVID-19: A preliminary analysis of the impact on demographics and the insurance industry.” Charts on mortality rates from all countries analyzed show a seasonal pattern where the highest number of deaths coincide with the flu period. However, the outbreak of the SARS-CoV-2 virus in Mexico left a clearly unprecedented indicator: excess deaths in the second quarter of 2020 exceeded the average mortality rate per 100,000 inhabitants by 73% in that same quarter of the previous four years. The high levels of death between August and September 2021 also draw attention, which is when the Delta variant prevailed and vaccination uptake was not extensive. However, with the Omicron variant, the mortality rate is lower – and as the aforementioned report points out, it even dips into negative numbers.

For its part, as with countries in the Northern Hemisphere, Germany exhibits a mortality pattern typical of the winter and the influenza period. However, in the spring of 2020, an increase of almost 8% of the average mortality rate is observed in that same period in the previous four years. At the end of 2020 and early 2021, the Alpha variant hit the German population hard, when the vaccination uptake was still incipient. In December 2020, the mortality rate was 30% and the following January, it almost exceeded 21%.

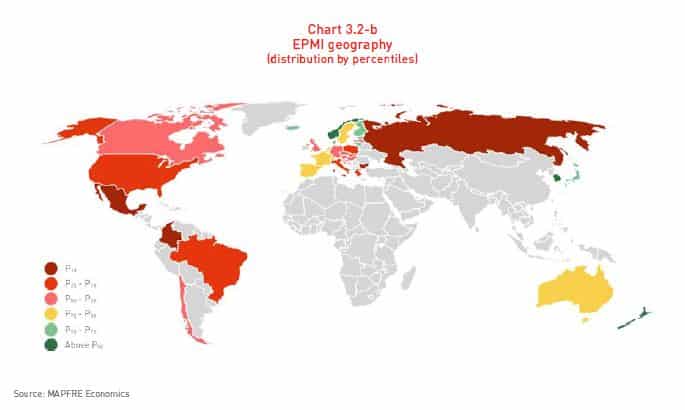

Analyzing the overall computation of the data, the report reflects that both exogenous and endogenous factors have been crucial for the numbers of contagion and mortality to have been one or the other. During the speech, Gómez Guerrero also referred to the Pandemic Management Efficacy Indicator, an indicator “which is intended to assess the degree of efficacy of the measures adopted in the sample of 39 countries analyzed in this report”. It is composed from 5 indices: excess mortality, full-regimen vaccination, economic performance, healthcare responsiveness, and finally, level of restrictions imposed.

As reflected in the infographic included in the report, from all the countries studied, South Korea has the highest level of efficacy, followed by Norway and New Zealand. A noteworthy case is that of Japan and its health system, which is considered the best in the world, as it has managed to combat the pandemic with a lower level of mobility restrictions compared to the rest of the countries in the sample, although its economy was very affected. On the other side of the spectrum, the lowest-rated countries include Mexico, Colombia, Bulgaria, Russia, and Brazil.

In the roundtable discussion following the presentation, experiences were shared about how MAPFRE reacted in Latin America to the challenges of the pandemic, both at the Corporate level and in supporting its Customers and Providers.

At the Corporate level, noteworthy factors were MAPFRE’s alignment with the messages from the respective governments and health authorities, the support through direct donations from Fundación MAPFRE in the most affected countries, and the establishment of coordination committees in each country and region, in addition, of course, to those at the MAPFRE Group level.

With regard to Customers, it was the actions of reinforcing remote communication channels and the telemedicine service that attracted the most attention of the participants in the roundtable discussion, as well as the efforts to mitigate the economic impact on customers by extending collection periods and reducing renewal premiums for certain products in some countries while accelerating payouts for claims.

Finally, emphasis was placed on the network of Providers, who were able to count on MAPFRE to alleviate stress on their cash and support them in managing their own administration through online tools.

Ultimately, to conclude, the emergence of the SARS-CoV-2 virus tested the economic, health and logistics systems globally. The true power of multinational companies could be seen both in the level of solvency and in the speed of responsiveness on the corporate level, but of course, also with their Customers and Providers, and undoubtedly, in relation to their employees – those who offered and are offering benefits for their employees made the difference in the COVID-19 pandemic experience.

Keed reading… The market reaction to COVID-19 and its reflection in insurance and reinsurance clauses