29/01/2026

In a global environment characterized by uncertainty, technological acceleration, and interconnection of markets, risk management has shifted from being a marginal or reactive function to becoming a central element of modern business management. Managing risks today doesn’t just imply avoiding losses – it’s about anticipating changes, protecting the value of the organization, and creating the necessary conditions for sustainable growth.

Risk management functions as a systematic, continuous, and structured process that allows enterprises to identify, analyze, evaluate, and address the risks that affect it as it progresses along the path to meeting its objectives. This process isn’t limited to a specific department, but rather spans all levels of the company and is integrated into its culture, governance, and strategic decision-making.

One of the fundamental features of effective risk management is its cross-cutting nature. Everybody, from senior management to operational teams, has a responsibility to identify and control risks within their scope of action. Furthermore, the company doesn’t operate in a vacuum – it’s in constant interaction with customers, suppliers, regulators, employees, and society in general. These stakeholders influence, and are influenced by, the way the organization manages its risks.

From traditional management to Enterprise Risk Management (ERM)

For many years, organizations addressed risks in a fragmented manner. Financial risks, operational risks, technological risks, or regulatory risks were managed separately, from different departments and without a global vision. However, this approach proved to be insufficient, especially in the face of complex and systemic crises.

This context gives rise to Enterprise Risk Management (ERM), which proposes a holistic approach whereby all risks are analyzed together, considering their interdependencies and their added impact on the value of the organization. This vision allows senior management to better understand total exposure to risk, prioritize resources, and avoid isolated or contradictory responses.

The main contributions of the ERM include:

- An ability to identify risks company-wide

- Integrated responses to multiple risks and

- Optimized use of resources.

- Synergies are sought that reinforce global protection of the organization and improve its efficiency.

What do we mean by risk?

Risk is commonly defined as the combination of the probability of an event occurring and the consequences derived from said event. In practice, it’s common to distinguish between pure risks, which only generate losses (fires, accidents, theft), and speculative risks, associated with business decisions that can either produce profits or losses, such as investments, innovations, or market expansions. Although both types are relevant, in areas such as safety, occupational health, or the environment, the focus is primarily on preventing damage.

Similarly, risk can be analyzed from an objective dimension —measurable through probabilities and statistics— and from a subjective dimension, related to perception, experience, and the attitude of people towards uncertainty. Risks can also be analyzed according to their origin: strategic, operational, financial, related to knowledge, or related to legal and regulatory compliance.

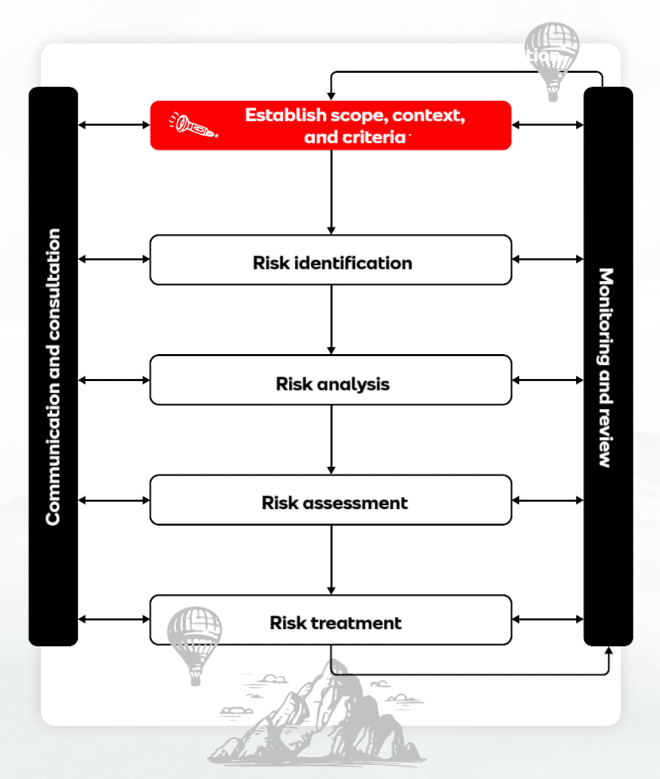

The process of risk management

Risk management follows a logical and orderly process, which facilitates its integration into enterprise decision-making. Everything begins with the definition of scope, the context, and the risk criteria. The organization must clarify what its objectives are, in which environments it operates, and what levels of risk it is willing to assume based on its strategy, its culture, and the exposed assets.

Risk management follows a logical and orderly process, which facilitates its integration into enterprise decision-making. Everything begins with the definition of scope, the context, and the risk criteria. The organization must clarify what its objectives are, in which environments it operates, and what levels of risk it is willing to assume based on its strategy, its culture, and the exposed assets.

The context includes external factors —such as economic conditions, regulatory conditions, or social conditions— and internal factors, among which the organizational structure, corporate culture, information systems, and the valuation of exposed assets stand out.

Risk identification seeks to recognize all events that can facilitate or hinder the achievement of objectives. To achieve this, a wide range of techniques is used: from collaborative work sessions to audits, scenario analysis, or past incident studies. In industrial sectors, specific methodologies are used to analyze deviations of processes, potential failures, or root causes of accidents.

Once identified, the risks are analyzed, evaluating their probability of occurrence and the consequences they would have if they materialized. This analysis can be qualitative, quantitative, or mixed, and must take existing controls, interdependencies between risks, and the possibility that several events occur simultaneously into account.

To assess risks, the analysis results are compared with the previously defined criteria. This stage is key for decision-making as it determines which risks are acceptable and which require additional treatment.

Processing, transfer, and monitoring

Risk treatment consists of selecting and applying measures to modify it. These measures can be aimed at avoiding the activity that generates the risk, eliminating its source, reducing the probability of occurrence through prevention, mitigating the consequences through protection, consciously accepting the risk, or transferring it to third parties.

The transfer of risk through insurance remains the fundamental tool, widely used to manage residual risks. Insurance provides financial stability, facilitates recovery after a claim, and offers access to specialized prevention services. However, in recent years, alternative solutions have emerged that combine insurance, reinsurance, and capital markets.

The entire system is supported by two fundamental transversal activities: communication and consultation, which promote a culture of awareness and participation and monitoring and review, essential to ensuring that the system remains up to date, effective, and aligned with a changing environment.

Governance and risk culture

Effective risk management requires a clear governance structure. The risk policy must define the organization’s risk appetite, assign responsibilities, and ensure regulatory compliance. The board of directors sets the strategic direction, while the risk manager acts as a coordinator, cultural driver, and link between the strategic and operational levels.

The internal audit, for its part, provides an independent vision that reinforces the trust of stakeholders and contributes to the continuous improvement of the system. Ultimately, risk management is not just a set of procedures: It’s a way of thinking and acting in the face of uncertainty, a key competence for organizations that aspire to endure in an increasingly complex environment.

Author of the text:

Miguel Gallardo López

He belongs to the Risks Engineering Department at MAPFRE Global Risks and is responsible for the Organization and Customer Service Team. He is an Industrial Technical Engineer and has more than 30 years of experience in activities related to protection and engineering within MAPFRE since his beginnings at Itsemap.