The closer trade relations between China and Latin America began more than fifty years ago, but over the last decade this relationship has strengthened into a very important business partnership. While the so-called New Silk Road can be taken as a reference in this scenario, the alliance between the two regions goes beyond major infrastructure. China’s relationship with Argentina is a clear example of such development, as Alejandra Conconi, executive director of the Argentinian-Chinese Chamber of Production, Industry and Commerce, recounts.

China is currently a very important business partner for Latin America. Although it has been in the last decade that this alliance has become more established in the shape of major logistics infrastructure projects, this relationship has been ongoing for much longer, as Alejandra Conconi, executive director of the Argentine China Chamber of Production, Industry and Commerce explains to us. “China managed to finally negotiated its entry into the World Trade Organization at the beginning of this century, after a process lasting many years. In 2004, Hu Jintao —president of the People’s Republic of China from 2003 to 2013— came to Argentina as part of a Latin American tour, when his country was recognized as a market economy,” she explains.

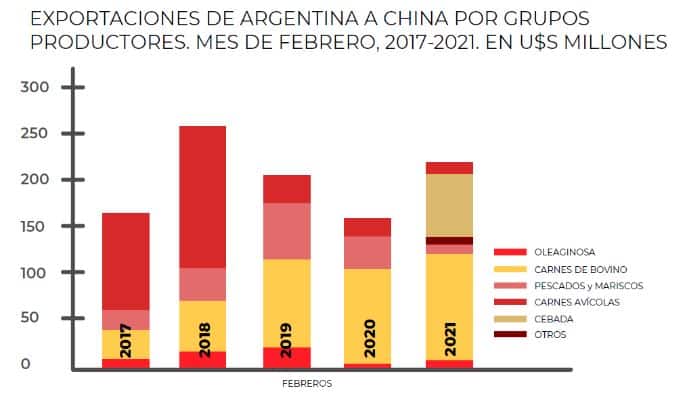

This milestone facilitated the initial negotiations that have evolved into the country becoming a strategic partner, one of the most important within the Chinese scheme of international alliances. There are deals that took more than a decade to negotiate, such as the meat business: “Today, 58% of Argentine meat production is destined for China. There have also been specific historical events, such as the trade war with the United States and the situation with Australia, that resulted in new quotas and products, like the case of sorghum and barley in the last two or three years, which Argentina previously had no possibility of exporting. That is to say, more opportunities are becoming evident,” Conconi explains.

Exports from Argentina to China in US$ million (Information from the Argentinian-Chinese Chamber)

How the business relationship has evolved

Starting in 2010, when the alliance between China and Argentina began to strengthen, the Asian country became a key player in foreign direct investment and financing “in agrifood, banking, telecommunications, mining and, very recently in lithium, where while there is investment coming from North America, South Korea, Australia and other countries, in terms of the number of projects and in importance China ranks the most significant,” reveals Conconi, recalling that it was precisely 12 years ago that “the Argentinian Central Bank issued an operational license to ICBC (China Industrial and Commercial Bank) which resulted in a big injection of capital into our country.” The expert, who has worked for more than fifteen years with Chinese companies, recalls that before that date “there was no day-to-day contact and, for this reason, many provinces in the interior of the country now have a relationship with Chinese parent companies for the first time, with all the added intercultural differences that this entails, because we come from countries with very different concepts of capitalism and labor relations.”

This difference was especially evident in terms of production times, primarily in the procurement and tender phases, which resulted in increased costs “which for any foreigner are already challenging, but for Chinese companies even more so.” This could be seen as one of the main challenges in building relationships between China and Latin America. “For them, any project here is small in comparison to the size of China’s own infrastructure works and internal trade. China is a country with long-term planning and projection, with five-year plans that move ahead of policy, and in Latin America this has to be adapted to the local situation, where we sometimes have a change of presidents and political parties. Fortunately, in these last few years, apolitical agreements have been drawn up that transcend politics, agreements that reflect State policy,” she says.

“This embodies cross-cultural adaptation, a major effort that ensures that a common methodology can be arrived at. Adaptation to the diversity of the Chinese and Argentinian people who are actually doing the work, and who make this sustainable over time,” she insists. Over the past decade, local companies with a focus on foreign trade are starting to look at the Asian giant, transcending the purely economic approach. “Confucius Institutes for the dissemination of the Chinese language and culture have arrived in the country, there has been support for defense at the G20 summit and everything that involved vaccine diplomacy during the pandemic was given with cooperation and on a donated basis,” she says.

The New Silk Road

In October 2013, President Xi Jinping launched the ‘New Belt and Road Initiative’ project, known in Spanish as “La Franja y la Ruta”, which symbolically emulates the old Silk Road, a millennia-old trade route that was China’s commercial trade link with the world. As Alejandra Conconi appreciates, this has been adapted to the 21st century. More and more sectors and regions have been added to this structure, which has materialized in the form of six land corridors and one sea corridor. Along with this geographical expansion, we must also add dimensions of connectivity that are not necessarily physical, introducing the adjective “digital” to the project.

In this context, and as Conconi explains in a report published by Anfibia magazine, China is an increasingly present reality in the business and political arenas of Latin America, and Argentina, which has signed up to the project through a Memorandum of Understanding. Based on this, the region has signed up for feasibility studies for a series of projects considered strategic by both countries. In recent years, Chinese capital has backed major renewable energy and large transport infrastructure works, while agreements on health and education have also been entered into.

“The Chamber of Commerce, which has refloated the idea of the China Investment Observatory in Argentina, is preparing a report to be published in early 2023 which estimates that investment will reach $40 billion across all industries,” the executive director explains, citing that this figure refers to “the purchases that a country makes of assets, ports, stockpiles and other infrastructure at the company’s risk. And this would not be the case, for example, with the dams in Santa Cruz and other works that are backed by a sovereign guarantee.”

Collaborating on this article…

Alejandra holds a Bachelor’s degree in Oriental Studies (USAL) and a Master’s degree in Social Anthropology (UNSAM), specializing in intercultural matters and business relations between Argentina and China. She is the Executive Director of the Argentine China Chamber of Production, Industry and Commerce.