admin | 07/03/2019

Paola Serrano, Director of Aviation and Transport at MAPFRE Global Risks, has recently participated as a speaker at the Conference on Spanish Regulations and requirements for placing a satellite in orbit, organized by the Spanish Association of Aeronautical and Space Law (AEDAE), during which the main characteristics of this market were analyzed.

Characteristics of the satellite insurance market

Satellite insurance has very special characteristics that distinguish it from other insurance products.

To begin with, it should be pointed out that insurable satellites are artificial satellites, which, unlike natural satellites, have been built by man and their use is fundamentally focused on two purposes:

1) Observation: satellites take photographs and collect data for very diverse uses, such as meteorology, helping to monitor and determine climate, and to predict natural disasters, such as hurricanes and tsunamis.

In addition, they are used for observing outer space, searching for planets, measuring atmospheric composition, etc.

2) Communication: satellites allow the retransmission of signals from one point on the Earth to another in real time, making radio, television, internet, telephony or geo-positioning system transmissions possible.

In addition to their type of use, they can be distinguished according to their orbital position. The most used in all of space history can be classified under five types: LEO, MEO, GEO, HEO and SSO. Each has its advantages and disadvantages, and they are used according need.

GEO and LEO satellites are used in communication and observation, and weigh more than 150 kg.

GEO satellites, or geostationary satellites, are located 36,000 km from the Earth, exactly on the equator line and, as their name indicates, they rotate in tune with the geostationary orbit, in such a way that it seems like they remain static from the surface of the Earth. These are large, robust, highly-tested satellites whose price can exceed USD 500 million. They are designed to operate for periods of 15 years, move slowly and are ideal for ensuring telecommunications.

On the other hand, there are the so-called LEO (Low Earth Orbit) satellites, smaller in size, which are located 2,000 km from the Earth and revolve quickly around it. Their price is lower compared to geostationaries and they provide service for a maximum of 5 years. These satellites are suitable for Earth observation functions.

MEO (Medium Earth Orbit) satellites are located in an intermediate circular orbit, between 2,000 and 36,000 km from the Earth’s surface, with an average orbital period of several hours (12 hours on average).

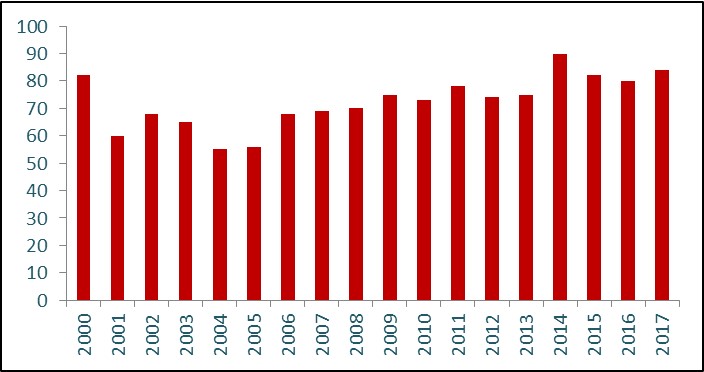

The chart below shows the number of GEO and LEO satellites weighing more than 150 kg placed in orbit annually since 2000.

Chart 1: Number of launches

Number of launches. Source: XL Group

According to this table, the number of satellites remains stable and shows no sign of growth. As can be seen, the minimum of 60 satellites was launched in 2004, giving an annual global average of 75 launched satellites.

It is also important to note that not all satellites that are launched are insured. Insurance policies are only taken out for a percentage of them to cover damage during launch.

Chart 2: Market for insured and uninsured satellites

According to the data presented in Chart 2, 2010 was the year with the fewest secured satellite launches (36%) compared to 2017, which is presented as the year with the highest number of secured satellites (60%). In summary, taking into account that 85 satellites were launched in 2017, it can be observed that only 51 secured their launch, and the rest were launched without coverage for this risk.

Insurers who underwrite space risks must have specialized equipment and a great deal of knowledge of the product’s technical characteristics.

What is satellite insurance?

Satellites have two critical moments for which there are two coverages: their launch and their life in orbit.

1) The launch phase: this is the moment when their engines are switched on (the moment of greatest risk in their operation), and although technological advances have brought greater security in this regard, it still involves an important risk. This phase is considered to end when the satellite is separated from its launch vehicle. This is when the phase known as life in orbit begins.

2) Life in orbit: once the satellite has been separated from the launch vehicle, the 12-month life in orbit coverage comes into force and is renewed annually until the end of satellite’s useful life, which is usually around 15 years for communications satellites.

Satellite Insurance Coverage

Insured sum

On the other hand, it should be stressed that the insured sums in this market are very high, since the insured value of a geostationary satellite can reach USD 500 million. It should also be noted that several satellites can be projected from the same launcher at the same time. This can lead to an accumulation in the insurance markets, a situation that every insurer wants to avoid, as it involves the possibility of suffering a high potential loss.

In line with the above characteristics, it is logical to guess that the number of insurers operating in this sector is also small: only about 40 worldwide.

It is important to consider that all insurance companies underwriting satellite insurance must operate globally and be able to insure any satellite anywhere in the world in order to have a balanced and dispersed portfolio of risks.

In addition, insurers who underwrite space risks must have specialized equipment and a great deal of knowledge of the product’s technical characteristics.

High insured sums: up to 500 million per satellite and launch

In line with the characteristics already mentioned, claims in this market are extremely complex. Leaving aside the assumption of total loss, where the settlement of the claim is made on the insured sum, the settlement of a partial loss involves the establishment of a series of working hypotheses to conclude what percentage of the useful life of the satellite has been affected by the loss and, therefore, how much compensation is due to the insurer.

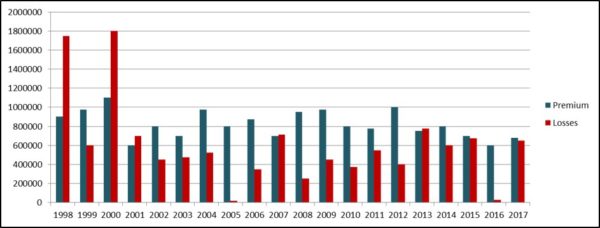

Chart 3: Worldwide Statistics – Annual Premium vs. Claims

Source: XL Group

These difficulties are aggravated by the simple fact that the insurer cannot send its expert to analyze the claim and has to base all its contribution on the information supplied by the insured party.

Market outlook and the challenge of the insurance market

The vertiginous evolution of the activity linked to satellites shows a trend of continued growth in the coming decades through the manufacture of smaller devices, and the performance of multiple, more economical, launches.

Nanosatellites have opened up a new paradigm in terms of access to space, something that was previously accessible only to large companies. However, they are still in a very early stage and, according to the statistics, still have a high mortality rate.

Nanosatellites often use commercial components that are unprepared for space. They also do not implement redundancy systems in the event that something goes wrong, thus reducing their complexity and cost.

The fact is that the rapid evolution of new applications and technologies poses a challenge for the insurance industry, as it entails a diversity of risks that must be assessed and responded to.

In this sense, the challenge that the insurance industry must face is to act as a driving force for innovation and to collaborate in order to understand the complexity and dynamism of the space industry.

MAPFRE’s beginnings in satellite insurance

The Aviation area at MAPFRE is almost as old as the activity itself in Spain, as the company has been offering its insurance programs since the founding days of the commercial airlines.

Subsequently, with the development and commercialization of communications satellites in Spain, MAPFRE began to participate actively in space risk policies, first with the HISPASAT 1 A satellite in 1990 and then HISPASAT 1B, and the 1C, until becoming the leading insurance company in Spain for the insurance of this industry.

In this way, the Aviation and Space area was formed, which progressively extended beyond Spanish borders, by participating in programs involving a large number of international satellites, positioning MAPFRE as one of the main insurance companies dedicated to this insurance worldwide.

Paola Serrano García, Director of Aviation and Transport, MAPFRE Global Risks

Paola Serrano García, Director of Aviation and Transport, MAPFRE Global Risks

Paola has a degree in Law and Economics from the Universidad Pontificia Comillas. She joined MAPFRE INDUSTRIAL in 2001 as Branch Manager, and in 2005 she was appointed Director of the Aviation and Space Business Area.

She is currently the Director of Aviation and Transport at MAPFRE’s Global Risks Unit.