admin | 26/10/2021

We share an article written by Juan Francés, MAPFRE’s Deputy Director of Communication, in which he analyzes how digitization is transforming all areas of economic activity, resulting in changes to companies risk profiles and the nature of the assets that they want to protect against unforeseen events.

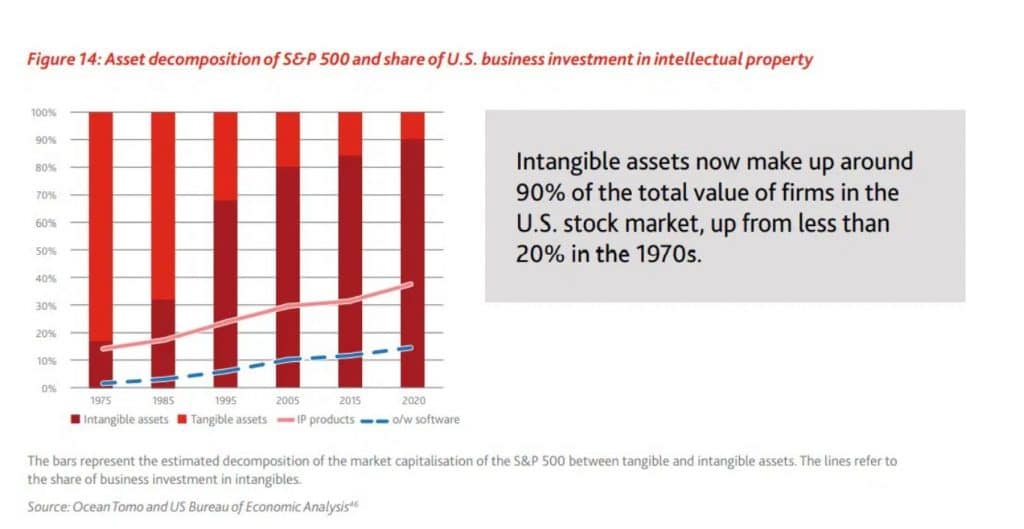

Digital companies are facing new and emerging risks, such as cybersecurity. Rather than physical assets, the value of digital companies is predominantly derived from intangible assets, such as data, intellectual property (IP), software, employee talent and knowledge, and the reputation of the companies themselves. By some estimates, intangible assets now represent about 90% of the total market value of S&P 500 companies. At the same time, surveys reveal that less than 20% of these types of assets are insured.

This presents both opportunities and challenges for the sector, as explained in the latest report from the Geneva Association, Digital Entrepreneurship and the Supportive Role of Insurance, by Darren Pain.

Traditionally, a company generated economic value through its physical capital (stock, buildings, machinery and equipment) and human capital, its employees. As a result, the value of the tangible assets recorded on its balance sheet (less any liability recognized as debt) once provided reasonable guidance on a company’s equity. Today, the value of a company is far more related to intangible assets (that is, knowledge-based), such as reputation, human capital and intellectual property, some of which are not well-represented on conventional financial statements.

While the rise of big tech companies epitomizes change, the phenomenon is more widespread. The vast majority of industrial companies, as well as small and medium-sized companies, have adopted digital business models. The share of intangible investments in total U.S. business investments has increased substantially. This movement was quite advanced before COVID-19, although the pandemic has accelerated the trend, and digital transformation now takes weeks rather than months or years.

Along with intangible assets, there are intangible values that are becoming increasingly important, such as companies’ reputation. “Proper management of a company’s intangible assets is a net contributor of value to business development, and this is especially important in today’s information society,” explains Eva Piera, MAPFRE’s Chief External Relations and Communication Officer.

This transformation of the nature of corporate assets has repercussions in all spheres of economic activity, and naturally, it also impacts the role that insurance can play.

Throughout history, insurance has helped companies develop markets for new products and services, and this is certainly the case with digital technologies as well. We are already seeing business liability policies and cyber and intellectual property insurance coverage evolve to accommodate some of the intangible risks faced by digital entrepreneurs. However, if insurers are to meet digital entrepreneurs’ needs and fill the emerging coverage gaps, they will need to enhance the value proposition of their offers, particularly through product, process and organizational innovation.

In the digital world, compensation is unlikely to repair the damage suffered. In the physical world, there are also “irreparable losses” (such as losing your home or a loved one), but most coverage is aimed at compensating for the material: if you have a leak, it is repaired; if your warehouse is robbed, you are compensated; etc. In the digital world, everything is more complex. A company that suffers a ransomware attack and loses all its data, including its customer base, will be able to cover risks such as the cost of equipment, the cost of business interruption, the cost of possible fines for data breaches … but none of that restores normalcy to your business.

“For this reason,” explains Joan Cuscó, MAPFRE’s Global Head of Transformation, “if we want to protect everything that matters to our clients just as we do in the physical world, insurers must develop a comprehensive offer that encompasses the entire digital-security management cycle: awareness, prevention, action, recovery and compensation, the latter being perhaps the least important link in the chain.”

In its study, the think tank, made up of the top international insurance companies, including MAPFRE, explains that such innovation by insurance companies can arise in three key areas:

- Product innovation: “Parametric coverage can play a more important role in situations where losses are related less to bodily injuries and physical damage and more to lack of access or poor performance of products/services.”

- Process innovation: Automated underwriting and streamlined distribution, including through partnerships with Insurtech environments, will facilitate flexible, customizable coverage for digital businesses.

- Organizational innovation: Reconfiguring their businesses to adopt API strategies will allow insurers to connect with digital platforms and collect relevant information for business.

This will reveal significant opportunities to design highly granular risk-calibration models and create new insurance propositions that are attractive to digital entrepreneurs.

Publication at MAPFRE´s web:

The intangible is increasingly important to companies (mapfre.com)