Technological transformation is having a huge impact on companies in key sectors of the economy. Finance, insurance and real estate are proving to be fertile ground for introducing innovations meaning that “tech” startups are competing and collaborating with the major companies in these fields in order to adapt to the needs and expectations of the new digital customer.

While it is true that in the second half of the nineties, with the expansion of internet use, online banking and e-commerce, technologies began to emerge focused on financial services, it was in 2008 that these companies began to boom. The world economic crisis came at a time of social renewal, encouraged by global digitalization and interaction (with the resurgence of social media), leading to a change in consumer mentality and the way their habits evolved.

Given this context, the emergence of Fintechs is understandable. These were the first and most powerful “tech” companies, specialized in adopting a variety of financial services based on technology. A ten year period during which innovation has relentlessly expanded into other predominant branches of the world economy.

“Between 2010 and the beginning of 2017, the number of companies in the Fintech sector worldwide grew from around 3,000 to over 8,800”

Even so, between 2010 and the beginning of 2017, the number of companies in the Fintech sector worldwide grew from around 3,000 to over 8,800 (an annual average growth rate of more than 19.6%), and went from moving 15,300 million dollars to 101,000 million (+37.8% every year), according to data from the Foundation for Financial Studies (FUNDEF).

Indeed, in Spain, the digitalization being carried out by companies in a variety of sectors is seen as the main challenge for the future, both in terms of increasing turnover and optimizing costs, as by the transformation of the internal mindset of the people and the culture of the organization that this entails. It is a transformation that must be driven by the management and led by the entire team of people who make it, it is clear that only companies that are able to insert the digital chip into the DNA of the organization will be those that reach successfully the digital challenge.

According to estimates by Roland Berger, in a study for Siemens, the digital maturity of Spanish companies in key sectors of the economy could increase the country’s GDP by 120,000 million in 2025.

The digital customer

This technological transformation is leading companies to change their business models, previously based on the product, to now focusing their full attention on the customer. However, consumers these days are completely digitalized and their interaction with companies is increasingly less face-to-face and more telematic, allowing them to gather a greater amount of information (taking more effective decisions) to make the shopping process quicker and more efficient. A digital customer who reigns supreme in the marketplace.

A recent study by Capgemini reveals that 50% of the world’s banking and insurance users already take advantage of services and products within the “tech” ecosystem. Spain is the leading country in Europe and fifth in the world in terms of using these services, only superseded by China, India, the United Arab Emirates and Hong Kong.

In this respect, and in response to this demand, “tech” companies are proliferating. So much so that the firm claims the sector in Spain has grown 300% over the last year, which means that “one of these kinds of company is set up in Spain on a weekly basis”. In July of this year there were already 308 Fintech and 102 Insurtech companies in Spain, according to updated figures from Finnovating.

Companies are specifically focusing their digitalization on making their customers’ digital experience as satisfactory as possible, which is why they are committed to the maximum amount of personalization and differentiation. To achieve this, they need to know as much as possible about consumers, compiling data on them through analysis, contact and consumption flows, the devices used for access, their historical relationship with the company, etc. This is the only way for them to be able to provide services with added value.

“This technological transformation is leading companies to change their business models, previously based on the product, to now focusing all of their attention on the customer.”

Technology allows these complex procedures to be carried out and new user experiences are constantly being tested, enabling companies to develop their service offering and adapt it to different channels. Sometimes traditional companies are unable to access these costly mechanisms, so they are forced to hire the services of Fintech and Insurtech, or use trial and error methods such as creating “digital shop windows” that operate 24 hours a day or by introducing gamification features to attract digital customers.

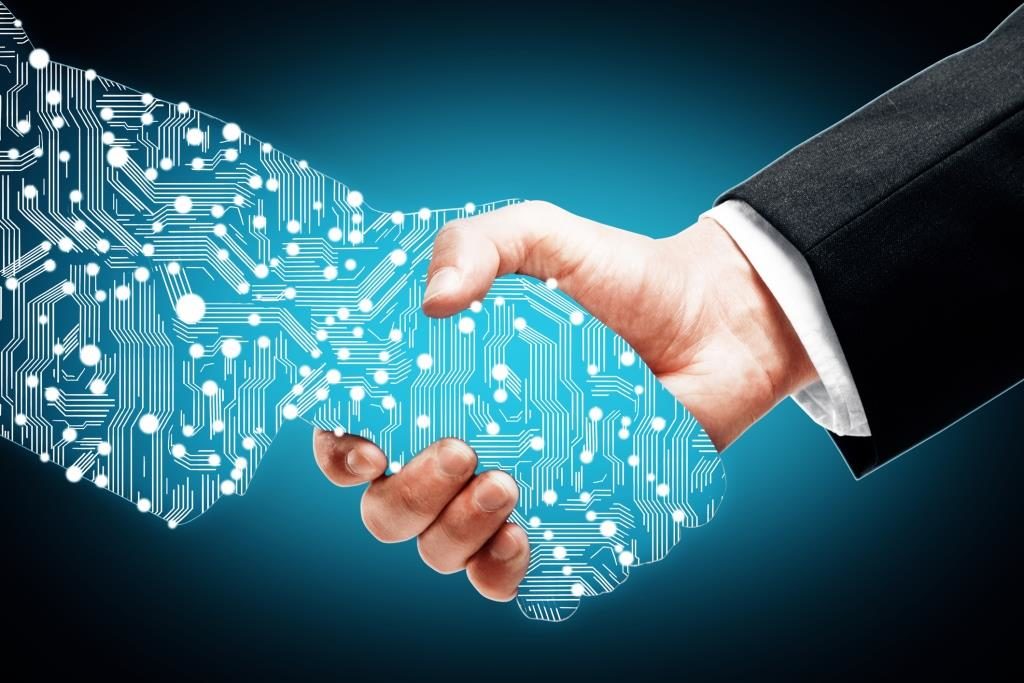

Experts believe that the future of all these services lies in mutual cooperation to the benefit of the consumer. For traditional companies, this is about working harder to improve their customers’ experience. And in the case of the “techs”, the opportunity lies in guaranteeing protection against fraud, improving service quality and transparency.

Graph: The world´s most digitalized sectors

Competition or opportunity?

Specifically, the Spanish Fintech and Insurtech Association (AEFI) explains that the success of the sector in Spain is due to Fintechs providing customers with financial services in a more dynamic and efficient way, thanks to the enormous access of the population to new technologies and to a more reliable use of big data and advanced data analysis. All this is leading to traditional companies losing market share (it could be that new technologies are putting up to 24% of their revenues at risk, according to a study by PwC) and they are now fully committed to digital transformation.

Although a certain amount of competition may be involved, the true value of technological startups is actually based on collaboration, helping finance, insurance and real estate companies (along with many other sectors) to carry out the digital transformation demanded by modern times, thus expanding their portfolio of products and services. All of this is due to their greater capacity for innovation, generally focusing on a single solution, and to their greater regulatory freedom through not being covered by specific legislation. The figures speak for themselves; while Proptechs invest, on average, 43% of their annual turnover on technological development, the percentage for traditional companies is only 5.5%, according to data from Finnovating.

In fact, 45% of traditional finance companies acknowledge that they now have some kind of agreement with Fintechs and 82% state that they intend to increase the number of alliances over the next three to five years, according to PwC’s 2017 Fintech Report. However, bank business leaders predict that their investment in these technological companies will produce a return for them of 20%.

“Tech” solutions per sector

Fintechs, Insurtechs and Proptechs are the technological companies that have most influence in the markets. But digitalization is increasingly expanding to ever more sectors and the solutions they offer are enhancing customer experience:

– Fintech (financial sector). Digital payment methods, customer service via ‘chatbots’, blockchain and smart contracts to automatically implement contracts and personalized services using artificial intelligence, to name but a few

– Insurtech (insurance sector). Insurance comparison sites, online consultancy platforms, pay-per-use insurance, claim assessment by phone, etc.

– Proptech (real estate sector). Marketplaces, home buying and selling through blockchain, enhanced and virtual reality in the marketing of apartments, domotic devices, valuations and geolocation using data, P2P platforms, etc.

– Wealthtech (asset management sector). Online investment platforms (robo-advisor and quant-advisor), micro-investment apps and platforms for managing investment portfolios.

– Healthtech (health sector). Big data applied to managing the data of patients and healthcare professionals, online diagnosis, healthcare apps and wearable monitoring devices are just some of the examples.

– Legaltech (legal sector). Self-service legal platforms, automation of legal processes and tasks, legal marketplaces and obtaining digital evidence, among others.

– Regtech (regulatory compliance). Automation of reporting and risk control tasks, identity management using biometrics and anti-fraud monitoring through the digitalization of finances are some of the most common uses.

Current legislation: an obstacle course

The problem is that, although they are necessary, alliances between traditional and technological companies need to overcome a series of obstacles to become consolidated and this sometimes delays the signing of agreements. The PwC study highlights issues relating to cybersecurity, the differences in management models and corporate culture and discrepancies in business models as being among the aspects of most concern.

But one thing that both traditional organizations and the new technological firms agree on in terms of innovation are the obstacles posed by current legislation, especially when it comes to data storage and protection and authenticating digital identities.

“Traditional organizations demand the same regulation and supervision for startups in order to protect the consumer and guarantee fair competition.”

Furthermore, Fintechs are not covered by specific regulations, but the banking control body of the European Union (European Banking Authority) is now preparing new rules to regulate the sector that are expected to apply from January 2019. But there is also controversy over this issue, in that the traditional banking sector is insisting that Fintechs are subject to the same regulations and supervision that governs its own activity in order to protect the consumer and guarantee fair competition.

The insurance industry is taking the same line. The Spanish insurance association Unespa points out that the regulations governing insurance companies are especially strict, so that any actor wishing to operate in the industry should comply with the same requirements of “solvency, stress assessments, corporate governance and internal and external information” as those that apply to traditional entities.