Julia Maria Gomez de Avila Segade | 22/09/2022

In March 2020 and in the context of the pandemic, after the first weeks of global lockdown, supply chains were disrupted, significantly impacting sea transport and port activity. Ricardo J. Sánchez, senior economic affairs officer of the ECLAC’s Division of Commerce, Infrastructure and Integration, tells us what was learned during this long period of crisis and the challenges that the sector is still facing.

The COVID-19 outbreak in 2020 dramatically changed the political, social and economic scene on a global scale. When WHO ruled on the global emergency, most governments imposed strict lockdowns in their countries and business activity was dramatically reduced. Although freight transport, as an indispensable means to overcome the health crisis, was considered an essential service, freight volume and supply chains were greatly affected, which significantly impacted maritime and port activity. “The world practically halted. There were border closures and a lot of cargo was left on the road because it could not leave or reach the ports. In addition, all of this happened very soon after the Chinese New Year, a festive period in which China comes to a standstill, so a feverish period had just begun to compensate,” explains Ricardo J. Sánchez, senior economic affairs officer in ECLAC’s Trade, Infrastructure and Integration Division.

The accumulation of cargo at strategic points in the logistics network and the fragmentation of routes marked the context of those first months of the pandemic in which the sector depended on government decisions made primarily for health reasons. “In Latin America, for example, port activity was absolutely restricted to national regulations. The security measures established to reduce contagion were successful, but affected the workforce,” the head of the Division of Commerce, Infrastructure and Integration of the ECLAC acknowledges. All administrative actions—entry of goods, customs control, etc.—were disrupted.

Impact of the pandemic in numbers

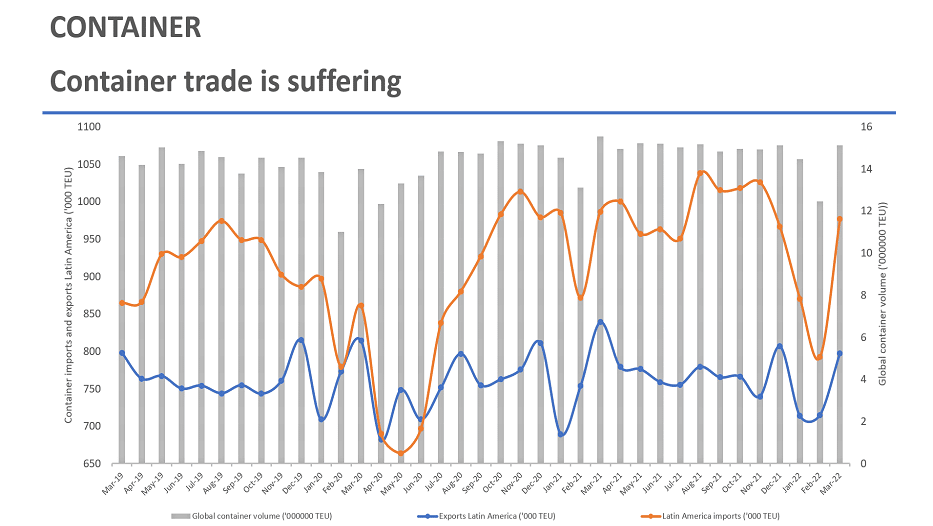

One of the indices that allows us to assess the impact that the pandemic had on global logistics is the movement of cargo in the ports of the region, which fell markedly. “For example, in March 2020, 860,000 import containers were moved in Latin America. In May it was at 650,000, i.e. there was a 20% drop in activity from one month to the next, and exports also fell significantly,” explains the maritime and port economics expert. Those falls forced us to review the stability and increase forecasts. According to data from ECLAC, from a forecast of 3.6% growth in world container trade in the last quarter of 2019, the forecast has shifted to an estimate of a -7.2% decline —published in July 2020—.

After that initial halt, trade resumed in an extraordinary way, mainly in China. “Just as the decrease had been sudden and strong, it was the same in the opposite direction. The first opening decisions also happened in Latin America and the port activity was overwhelmed by the reactivation and the delayed operations. In November 2020, we found ourselves in a splendid situation: it increased almost 40% from the year low,” explains Ricardo J. Sánchez. The ECLAC technician attributes this rebound to a widespread change in consumption habits, with a decrease in services and a shift towards tangible goods.

Evolution of container trade (March 2019 – March 2020)

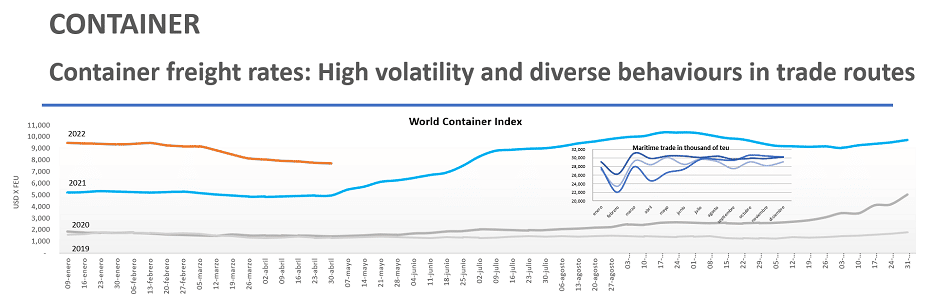

One of the effects of this change of trend is so-called blank sailing, i.e. the interruption of a vessel’s stopover —skipping one point, one region or even its entire service—caused mainly by new market dynamics that affect the supply and demand of space in ports and, especially, tariffs. “It’s really a tremendous situation. Freight, in October 2019, was worth around $2,000. In 2020, it reached $2,500, and in 2021 that same container cost $10,000,” he explains.

Freight Price Evolution

With regard to the completion of services, 78% of services were actually completed on time in 2019. In 2021, that figure plummeted to 36%, and we are currently at 34%. “For example, a service from China to Spain, which entailed 80 days of travel under normal conditions and stopping at the relevant ports until reaching the destination, today takes no less than 100 days, and even up to 120 days. That is, the same service, the same ship, today takes up to 40% longer than it took in 2019,” says Ricardo J. Sánchez. This situation has caused significant damage to exporters and importers, and has also affected many sectors, as it has led to some shortages. “There is a lack of construction materials here in Chile because they don’t arrive or because they are priced too high. It also affects the automotive and technology industries,” he adds.

Challenges and Lessons Learned

Still immersed in the crisis, exacerbated by the conflict between Russia and Ukraine, the maritime and port sector is starting to investigate why these phenomena have occurred in transport and, although there are still no definitive responses, one major lesson has been learned: the great significance of logistics. “The importance it has in the functioning of the economy has become visible, but also in the daily lives of people, the world and all countries,” says the senior officer at ECLAC, who warns: “at some point there will have to be an international approach to this very relevant issue of container transport, which increased in price in the midst of a tremendous crisis such as the pandemic. Perhaps it should be the World Trade Organization that is in charge of reviewing what’s going on, seeing if international regulation is needed.”

At this complicated juncture, the port sector faces other challenges that place it in a demanding and exciting transformation process. In summary, Ricardo J. Sánchez says:

- Environmental commitment “to reduce the carbon footprint and overall emissions of port activity, incorporating best energy efficiency practices and the use of sustainable fuels,” he says. Other measures that could be taken in this area would be the incorporation of new technologies to optimize operations, manage waste and monitor the impact on the natural environment.

- Access to technology. Although it has already been incorporated into port activity, it is “a road that still has a long way to go and is a huge improvement challenge. It’s a dual challenge: to reach the highest industry standards for large ports, and adapt them to small and medium-sized infrastructures, so that the existing gap doesn’t continue to stretch,” he explains.

- Labor relations. “Working conditions have been a growing problem in recent times and require an urgent solution. Not only to reduce conflict, but also to increase the training of teams to meet technological challenges, mitigating mistrust and fears of job losses due to the incorporation of this innovation,” he warns.

- Improving the connectivity infrastructure between ports and the interior of the economy. “This is also a big deficit in Latin America,” the expert said, deeming that more infrastructure investment is necessary and that this is done from an environmental responsibility perspective.

- Adapting the ports. “Over the last fifteen years there has been a very accelerated increase in the size of ships, which have tripled their cargo volume. This requires deeper, technologically capable container handling ports able to support a much greater weight,” says Ricardo J. Sánchez, who calls for “a larger, more resilient and sustainable infrastructure. And, as I said before, worker training,” he concludes.

Contributors to this article:

Ricardo J. Sánchez is a doctor of economics and an internationally recognized expert in maritime and port economics, as well as transportation and infrastructure, with special emphasis on the Latin American and Caribbean region. He has worked professionally or academically in 30 of the 33 countries in Latin America and the Caribbean over 32 years, as well as in Europe and Asia.

He is the senior economic affairs officer of the Division of Commerce, Infrastructure and Integration of the United Nations Economic Commission for Latin America and the Caribbean, where he leads a team of high-level professionals to conduct research and provide technical assistance and training to governments and private organizations on ports and logistics, infrastructure, maritime transport and trade.

Its main research interests are the maritime and port economy and the industrial organization applied to the maritime markets. He has been published over 200 times including books, peer-reviewed articles, work papers, etc. He is a member of the following academic and professional associations: the International Maritime Economics Association (IAME) and the Port Performance Research Network (PPRN). He is currently a member of PORTECONOMICS.EU, and an academic advisor to the Latin American AAPA delegation.

If you found this interesting, keep reading… The insurance and the Supply Chain Crisis