Worldwide and particularly in the Latin American region, casualty insurance has felt the impact of varying key circumstances which brought about a clear hardening of the market and undermined insurance capacity, as we will see below.

A history of CAT losses and the pandemic

From a global standpoint, in 2020, casualty insurance faced a hardening market that began in 2019 and consolidated over this year. Accumulated losses due to natural disasters around the world and the uncertainty surrounding the COVID-19 pandemic are two of the reasons why there was a shift in insurance capacity marked by fewer active companies and harsher terms and conditions for this business.

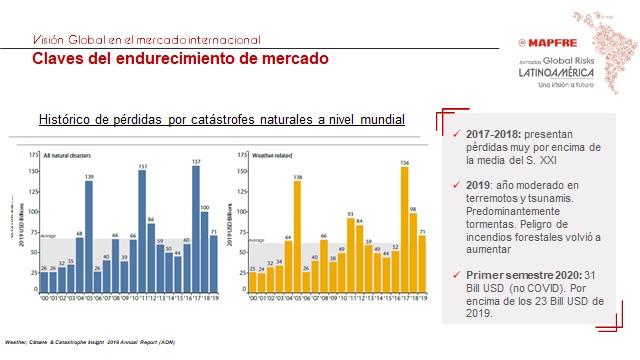

The first of the key points that explain the hardening casualty market is the history of accumulated losses due to natural disasters worldwide.

In 2017, 2018, and 2019, losses caused by these events surpassed the 21st century average, which is about 71 trillion dollars per year. While 2019 saw fewer earthquakes and tsunamis, storms caused a high loss ratio and there were more forest fires. Last year’s trends did not look particularly positive either. According to the data from the first half of 2020, there were losses of around $31 trillion, 8 trillion more than the first six months of 2019.

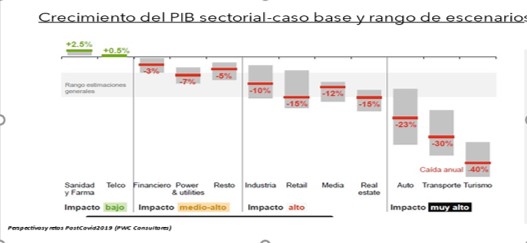

Another reason for the hardening of the market is the uncertainty of the future. COVID-19 has had a strong economic impact that has not been equal in all sectors. Some businesses came out stronger—such as Healthcare, Pharma, and Telecommunications—others, however, are in the midst of a great recession. The tourism industry is in the latter group. Hotel business is not expected to go back to pre-COVID levels until 2023. The auto industry (with sales plummeting 41%) and the iron and steel industry (with a projected 14.9% drop in steel) were another two of the hardest hit sectors.

Another reason for the hardening of the market is the uncertainty of the future. COVID-19 has had a strong economic impact that has not been equal in all sectors. Some businesses came out stronger—such as Healthcare, Pharma, and Telecommunications—others, however, are in the midst of a great recession. The tourism industry is in the latter group. Hotel business is not expected to go back to pre-COVID levels until 2023. The auto industry (with sales plummeting 41%) and the iron and steel industry (with a projected 14.9% drop in steel) were another two of the hardest hit sectors.

Changes to insurance capacity on the market

The impact of natural disasters and uncertainty have led to a notable change in the insurance capacity of the casualty insurance market. This translates to:

- Reduced capacity, as a result of the shutdown of Insurance and Reinsurance Companies. An eye-opening figure: in 2000 Lloyd had 125 unions and, in 2020, the figure went down to 96. At the same time, business lines were abandoned and risk appetite changed dramatically, which is where risk management takes on a fundamental role.

- Hardening of terms and conditions as a result of heavy dependence on the technical result due to the drop in financial income. In this context, coverage for socio-political acts and cyber risks is being excluded and premiums are going up, not only due to the need for a more appropriate technical rate, but also due to increased reinsurance contract protection costs, the reaction to which was shown in renewals for 2020 and a sign of upward trends for 2021.

Everything discussed above will equate to big consequences for the insurance business, which is dealing with some very complex postings, where reinsurance markets have more negotiating power and more diverse terms, which is difficult to overcome.

Market-specific characteristics

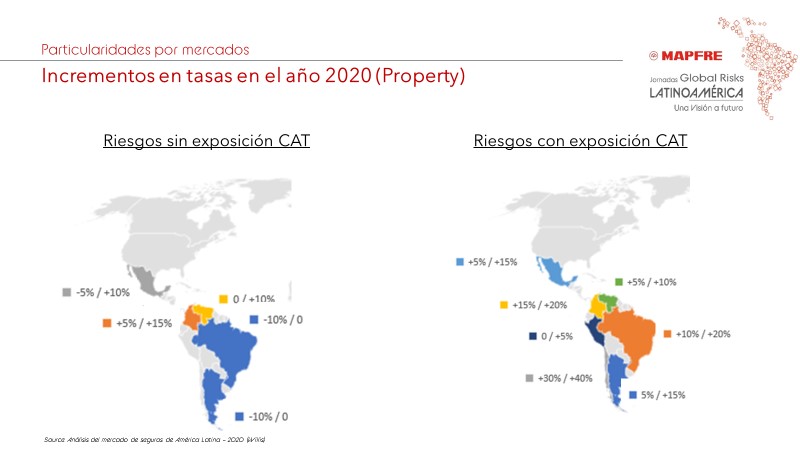

Casualty Insurance premiums did indeed go up. Between Q4 2019 and Q3 2020, premiums went up 21% around the world.

In the region of Latin America and the Caribbean, these increases were felt as of Q3 2019 and peaked in Q3 2020 at +15% on average. Areas with CAT exposure, countries like Brazil and Chile, and all of Central America are the areas most affected by these increases.

However, the rates’ trends are closely connected to the level of CAT exposure in the areas where the risks are located. In areas with low CAT exposure, in countries such as Argentina and Brazil, there have been premium decreases, while the maximum increases in other places reached 15%, as is the case in Colombia.

For risks located in areas with CAT exposure, rates are expected to go up in all markets. Chile is the country with the highest progression with increases between 30% and 40%. In countries where there are more moderate increases, it is mainly due to the existence of local markets that can fulfill part of that international reinsurance capacity.

Coverage in the line of fire

Additionally, the coverage exclusion for strikes, riots, and civil disturbances is expanded for casualty policies, particularly in retail activities located in urban centers. This restriction is based on the disturbances that occurred in Chile at the end of 2019, which resulted in losses of $1.3 billion for the insurance industry.

MAPFRE’s value proposition

In light of the hardening market, the message is clear and decisive: MAPFRE wants to continue leading its clients’ insurance programs sustainably in the long term by providing our own capacity and acting as a partner in local issuing.

In contrast with other insurance companies that have decided to abandon certain business lines or activities, MAPFRE is committed to continue providing its own capacity, which, whenever possible, will be a leading capacity. We have updated the underwriting policy for some industries, by adapting terms and conditions, and a great deal of work is being done with the Engineering Area in terms of inspection reports and monitoring recommendations.

Now more than ever the Casualty Department wants to better understand our clients: what activities they carry out and how they manage risk, which are extremely important aspects of underwriting today. Similarly, an in-depth analysis of CAT exposure was conducted to optimize provider capacity. And, in short, all these steps lead to much longer and more complex underwriting processes in which more information is needed and the processes are often drawn out over time. However, this is without a doubt very positive because it will help us further understand our clients and their needs.

The company’s own capacity will be supplemented with additional capacity channeling in the form of reinsurance support. At MAPFRE, we understand that there is greater exposure as reinsurance markets harden, which translates into shorter premium payment periods or increased control over claims.

At the Casualty Insurance Area, we also wish to demonstrate that we are working intensively on aligning the terms and conditions with the reinsurance market. In this regard, we are looking for coordination from our brokers who need to facilitate negotiations. The goal is very clear—provide our clients with clear and concise policies.

2021 is certainly not going to be an easy year. It will be full of challenges. At MAPFRE, we want to stand by our clients, strengthen our collaboration, help them, and establish long-term relationships with them.

The strength of numbers

Within its value proposition for Casualty Insurance, MAPFRE Global Risks has the guarantee of its numbers. 70% of the premiums written correspond to international programs, with a total of 57 programs issued for very diverse sectors: Metal, Mining, Hotels, Food, Paper, Infrastructure, and many others.

We are also one of the few companies that can issue fronting for captive insurance companies. In fact, they currently have 15 captive insurance companies inside their portfolio, with fronting premiums in captive insurance companies representing 28% of the total issue.

Cristina Peral is a chemical engineer specializing in the environment with 15 years of experience in the insurance industry. She started her career at MAPFRE in 2005 as the Technical supervisor of the ITSEMAP Emergency Plans Area.

In 2011, she began working in the MAPFRE Global Risks Underwriting Area and has been Head of Casualty Underwriting since 2014. In this position she is responsible for developing the business portfolio and coordinating with the underwriting team.